Click on graphic above to navigate the 165+ web files on this website, a regularly updated Gazetteer, an in-depth description of our island's internally self-governing British Overseas Territory 900 miles north of the Caribbean, 600 miles east of North Carolina, USA. With accommodation options, airlines, airport, actors, actresses, aviation, banks, beaches, Bermuda Dollar, Bermuda Government, Bermuda-incorporated businesses and companies including insurers and reinsurers, Bermudians, books and publications, bridges and causeway, charities, churches, citizenship by Status, City of Hamilton, commerce, communities, credit cards, cruise ships, cuisine, currency, disability accessibility, Devonshire Parish, districts, Dockyard, economy, education, employers, employment, environment, executorships, fauna, ferries, flora, former military bases, forts, gardens, geography, getting around, golf, guest houses, highways, history, historic properties, Hamilton, House of Assembly, housing, hotels, immigration, import duties, internet access, islands, laws, legal system and legislators, main roads, marriages, media, members of parliament, money, motor vehicles, municipalities, music and musicians, newcomers, newspaper, media, organizations, parks, parishes, Paget, Pembroke, performing artists, residents, pensions, political parties, postage stamps, public holidays, public transportation, railway trail, real estate, registries of aircraft and ships, religions, Royal Naval Dockyard, Sandys, senior citizens, Smith's, Somerset Village, Southampton, St. David's Island, St George's, Spanish Point, Spittal Pond, sports, taxes, telecommunications, time zone, traditions, tourism, Town of St. George, Tucker's Town, utilities, water sports, Warwick, weather, wildlife, work permits.

By Keith Archibald Forbes (see About Us).

Boardroom used by CEOs

![]()

Most of the individuals listed below have close links to or affiliations with the entities shown below.

See:

Bermuda's International Business, including Insurance and Re-insurance Companies

Bermuda Online's Business and Economy Index for applicable Bermuda Business Laws

| Dominic Addesso | In 2018 he earned a $7.1 million package as CEO of Bermuda-incorporated Everest Re. |

| Sheldon D Andelson | Billionaire. Casino magnate. US Republican Party's leading donor in 2016. President and major shareholder of Bermuda-based Interface Operations Bermuda Ltd. The company provides private jet services to Andelson's casino company, Las Vegas Sands Corporation. |

| Lord Michael Ashcroft | Formerly Michael Ashcroft, made a life peer in 2000, a former treasurer and now deputy chairman of the Conservative Party in England. British, estimated to be worth $93 million, one of the 500 richest British people in the world. He made a fortune in Belize and was once its Ambassador to the United Nations. He resigned in 2002 as a director of Bermuda-based Tyco International. His many interests include owning the majority interest in the Belize telephone company and Bermuda-registered Flying Lion, private jet airline. It Flies UK opposition politicians world-wide. Owned by millionaire Lord Ashcroft. Registered at Cedar Avenue in Hamilton. A Falcon 900EX allows its MP passengers to travel in comfort and style, with features such as supple leathers, glistening veneers and deep pile carpet as standard, according to French maker, Dassault. Also handles the Bermuda-based Punta Gorda Trust, in which he has hundreds of millions of dollars invested. This Trust was set up in April 2000 when Ashcroft stated he was not domiciled in the UK (a non-dom), with his three children named as beneficiaries. Ashcroft was named as the settlor and a beneficiary, the only one entitled to income for life. The trust became the focal point for a series of multimillion-pound capital distributions, loans and share transactions. Typical of trust activity is a document in March 2002 saying the trustees agreed to forgive a loan of $29.5m to Ashcroft. |

| Lord Anthony Bamford |

Left in Reuters photo above. Head of the family-owned JCB group, one of the world’s top makers of construction machinery. It has annual sales of sales of nearly 3 billion pounds ($4.5 billion). One of Britain’s best-known business leaders and a member of parliament. In the past five years he has given 2.6 million pounds to the Conservatives, elected on May 8 2015 as the ruling political party in Britain. In 2013 he became a Conservative member of the House of Lords, the upper chamber of the British parliament. With his brother Mark, below, the leading shareholder in multi-national JCB, controlled from its Bermuda corporate base. Joseph Cyril Bamford, father of Anthony and Mark, started the JCB empire in a rented lock-up garage in 1945. In 1956 he established J.C. Bamford Excavators Ltd, which became famous for making bright yellow backhoe loaders. It remains the group’s main operating company. The JCB group is ultimately controlled offshore by four discretionary trusts based in Bermuda, according to court documents and corporate filings. They include AB Bermuda Trust One and MB Bermuda Trust One — their father created in 1996, around the time he passed half of JCB to his sons, according to court documents filed in 2002 in Jersey. The beneficiaries of the trusts are Anthony and Mark Bamford and their families, according to court documents reviewed by Reuters. |

| Mark Bamford | With his brother Anthony, above, the leading shareholder in multi-national JCB, controlled from its Bermuda corporate base. |

| Sir David Rowat Barclay & Sir Frederick Hugh Barclay | British twins, among Britain's 500 richest people. Worth about £1.65 billion in hotels, property and publishing. They own The European, The Scotsman and Daily Telegraph newspapers of UK - the latter bought on 22nd June 2004 for £650 million - London's Ritz Hotel, and Channel Island of Brecqhou. Business interests are controlled by Bermuda registered BI Ltd. |

| Albert Benchimol | CEO of Bermuda-incorporated Axis Capital, earned $7.8 million in 2018. |

| Diana Bergquist | Daughter of the late Bermuda-resident billionaire Earnest Stempel, Bermuda-based philanthropist. |

| Silvio Berlusconi | Italian media magnate, believed to be worth more than US $7.8 billion. He and his family own a mansion, Blue Horizon, in Tucker's Town. A son is Piersilvio, there are also other children from his two marriages. He was the Italian Prime Minister for seven months in 1994, lost his first come-back bid in 1996, was elected Prime Minister of Italy again on May 14, 2001, was defeated in the Italian general election of April 2006 but became Italian Prime Minister for the third time in April 2008 and remained so until November 2011. He owns the top soccer club in Milan, Italy's top supermarket chain, Europe's largest private television network, magazines and a publishing firm. There are various books about him. On September 17, 2012 a montage of photos taken while the Duke and Duchess of Cambridge were on vacation at a relative's home in the south of France included the 14 pictures of the topless Duchess published by the popular French magazine Closer, which like Chi in Italy is owned by Berlusconi's Mondadori publishing house. |

| Jeff Bezos |

Shown in 2018 as the world's richest person, with a fortune estimated at $115 billion. Founder of Amazon Inc, the world's second-largest (after Apple) publicly traded company. Amazon has Bermuda-registered companies. The Bermuda Government has a sub-site on it. |

| Geoffrey Bible | Formerly Chairman of Philip Morris, which has a Bermuda subsidiary Philip Morris Capital (Bermuda) Ltd. |

| Michael Bloomberg |  Mr

Bloomberg, served as New York’s mayor from 2001-13. He has been

appointed the United Nations Secretary-General’s Special Envoy for

Climate Action and the World Health Organisation’s Global Ambassador

for Non--communicable Diseases. Bloomberg Philanthropies, which

encompasses his charitable activities, focuses on five key areas: arts,

education, the environment, government innovation and public health.

He is an American technology

wizard and frequent visitor to Bermuda with a vast home

overlooking the ocean in Tucker's Town, he founded a

global financial company - Bloomberg - in his own name, more than 75% of

which he still owns. 79 years old (in November 2019) he is the

wealthiest divorced man, with 2 daughters in New York City, with an

estimated US$18.1 billion in assets in February 2011. His Bermuda home was recently extensively re-worked at a reported

cost of $10.5 million. His neighbors there include Hugh

Lowenstein, billionaire Ross Perot

and former Italian Prime Minister Silvio Berlusconi. His other homes are two in

New York's Westchester County, Armonk, a townhouse at 17 E. 79th Street

in Manhattan, a 20-acre farm in North Salem, a London apartment in

Cadogan Square and a condominium in Vail, Colorado. His financial information and news services are widely

used locally. He was a 2001 Republican mayoral candidate for New York

City, won the election and became Mayor after November 6, 2001 (still in

office in 2011). He

has a fleet of aircraft at his disposal. A licensed pilot, he owns a

high-performance single-engine plane for quick jaunts. It is a Mooney

Bravo M20M, seats four, flies high and goes fast. On February 21, 2006

the New York Daily News reported that Mayor Bloomberg's presence

in Bermuda was about to get a whole lot bigger. His daughters, Emma and

Georgina, filed an application with the Bermuda Minister of Home Affairs

to buy The Jungle, a 1.7-acre property next to their dad's $10.5 million

mansion. The ultra-exclusive property is owned by Hugh Lowenstein, one

of Bloomberg's oldest friends and a member of his company's board of

directors. A Bermuda real estate agency described The Jungle as an

"exquisite property" and "magnificent house" with a

large galleried living room, replete with a cedar railing balcony

leading to the bedrooms. There's an outdoor pool in a beautiful garden

setting with a sloping lawn heading to a large dock. The house has four

bedrooms, five bathrooms and a fireplace in the living room. Mr

Bloomberg, served as New York’s mayor from 2001-13. He has been

appointed the United Nations Secretary-General’s Special Envoy for

Climate Action and the World Health Organisation’s Global Ambassador

for Non--communicable Diseases. Bloomberg Philanthropies, which

encompasses his charitable activities, focuses on five key areas: arts,

education, the environment, government innovation and public health.

He is an American technology

wizard and frequent visitor to Bermuda with a vast home

overlooking the ocean in Tucker's Town, he founded a

global financial company - Bloomberg - in his own name, more than 75% of

which he still owns. 79 years old (in November 2019) he is the

wealthiest divorced man, with 2 daughters in New York City, with an

estimated US$18.1 billion in assets in February 2011. His Bermuda home was recently extensively re-worked at a reported

cost of $10.5 million. His neighbors there include Hugh

Lowenstein, billionaire Ross Perot

and former Italian Prime Minister Silvio Berlusconi. His other homes are two in

New York's Westchester County, Armonk, a townhouse at 17 E. 79th Street

in Manhattan, a 20-acre farm in North Salem, a London apartment in

Cadogan Square and a condominium in Vail, Colorado. His financial information and news services are widely

used locally. He was a 2001 Republican mayoral candidate for New York

City, won the election and became Mayor after November 6, 2001 (still in

office in 2011). He

has a fleet of aircraft at his disposal. A licensed pilot, he owns a

high-performance single-engine plane for quick jaunts. It is a Mooney

Bravo M20M, seats four, flies high and goes fast. On February 21, 2006

the New York Daily News reported that Mayor Bloomberg's presence

in Bermuda was about to get a whole lot bigger. His daughters, Emma and

Georgina, filed an application with the Bermuda Minister of Home Affairs

to buy The Jungle, a 1.7-acre property next to their dad's $10.5 million

mansion. The ultra-exclusive property is owned by Hugh Lowenstein, one

of Bloomberg's oldest friends and a member of his company's board of

directors. A Bermuda real estate agency described The Jungle as an

"exquisite property" and "magnificent house" with a

large galleried living room, replete with a cedar railing balcony

leading to the bedrooms. There's an outdoor pool in a beautiful garden

setting with a sloping lawn heading to a large dock. The house has four

bedrooms, five bathrooms and a fireplace in the living room.

Michael Bloomberg and daughters |

| Sir Richard Branson |

Sir Richard Charles Nicholas Branson born 18 July 1950 is an English business magnate, investor, author, philanthropist and billionaire. He founded the Virgin Group, which controls more than 400 companies. They include Bermuda-incorporated subsidiaries. In 2018 his net worth was estimated at £4.9 billion and he was ranked eighth-wealthiest British billionaire by net worth. |

| Sergey Brin | An American computer scientist and Internet entrepreneur, multi-billionaire. He is best known for being one of the co-founders of Google (along with Larry Page), which has Bermuda subsidiaries and has used Bermuda extensively in its international tax avoidance dealings. Alphabet, Googles's parent, has sought to deliver major advancements in a variety of industries. Both Brin and Page and Brin are or were controlling shareholders of Alphabet. Brin and Page are co-inventors of PageRank, a well-known search ranking algorithm for Google. Brin received the Marconi Prize in 2004 with Page. |

| Nicholas Brown, Jr. | XL Capital. |

| James Bryce | IPC Holdings. |

| Warren E. Buffett | |

| Michael Butt | President and chief executive of catastrophe re-insurer Mid Ocean Ltd. One of the highly paid Bermuda based chiefs of global commercial insurers. |

| Mark Byrne | 2017. April 12. A founder and former chairman of Bermuda reinsurer Flagstone Re has died in Canada. Mark Byrne, who cofounded Flagstone Re with David Brown, died in Montreal last Thursday. He was 55. Mr Byrne was involved in the island’s insurance and reinsurance business as an owner, investor and board member for many years. Mr Byrne stepped down as executive chairman of Flagstone Reinsurance Holdings in 2010, shortly after Flagstone announced it had completed a redomicile from Bermuda to Luxembourg, although the company maintained its presence on the island. He helped found Flagstone in 2005, and after stepping down as executive chairman remained a board member for a number of years. Steve Coley, Flagstone’s governance committee chairman, said at the time: “Mark and David founded Flagstone together as partners and as the company has reached a certain level of maturity. Mark recommended and the board agreed that the executive leadership of only one of the founding partners is required to take the business forward.” Flagstone Re was acquired by Validus Holdings in 2012. Mr Byrne, originally from County Wexford, Ireland, was a qualified jet pilot and flew his own private plane around the world. He also headed Bermuda Government’s Education Board for a short time in 2009, standing down after six months due to what he said was a “a lack of political will” to improve the system. In 1993 he became chairman of Haverford, a holding company for insurance interests in Bermuda and internationally. Mr Byrne also set up Longtail Aviation in 1999. A self-confessed aviation fanatic, who started out learning how to fly gliders at age of 13, Mr Byrne said in 2008: “I love to fly whenever I get the chance. I fly helicopters, light planes, gliders, everything.” Longtail Aviation has offices in Martigny, Switzerland, and Halifax, Nova Scotia, as well as its headquarters at the Longtail Hangar in Southside, St David’s. Mr Byrne is survived by his wife Rebecca, four children, Sophie, Jacqueline, Matthew and Christopher, as well as his mother, Dorothy Byrne and brothers John and Patrick. |

| Earl Cadogan |

Owns the Cadogan Group of companies which include four incorporated in Bermuda. Worth over £2,85 billion. The Cadogan Estate has its origins in the historic Manor of Chelsea, London, purchased in 1712 by Sir Hans Sloane. |

| Rory Carvill | British, worth at least $36 million, one of the 500 richest British men. His Carvill companies, including R. K. Carvill (Reinsurance Brokers) Ltd are Bermuda registered. |

| John Charman | Tucker's Town resident. Multi-millionaire CEO/President/Director of Bermuda-based Axis Capital Holdings Ltd and Axis Specialty Ltd. Has over 30 years of experience in the insurance industry and has been in a senior underwriting position since 1975. From 2000 to 2001, he served as deputy chairman of ACE INA Holdings and President of ACE International. Was CEO at ACE Global Markets from 1998 to 2001, before that, CEO of Tarquin plc (a joint venture company among Insurance Partners, Harvard University and the Charman Group), the parent company of the Charman Underwriting Agencies at Lloyd's. He was a deputy chairman of the Council of Lloyd's and a member of the Lloyd's Core Management Group and Lloyd's Market Board between 1995 and 1997. A permanent resident of Bermuda and with property in the UK also, he was ordered in August 2006 to pay his ex-wife £48 million ($96 million) at London’s High Court in what is believed to be the biggest-ever settlement in a contested divorce case in British legal history. |

| Steven Cohen | American hedge fund manager, one of a number of big-name hedge fund managers to enter the insurance industry since 2012. Worth about $8.8 billion, founder of SAC Capital Advisors, which launched a Bermuda reinsurance company called SAC Re Ltd. with $500 million of capital in July 2013. |

| John Kent Cooke | The former president of the Washington Redskins football team in the USA. He is the son of Jack Kent Cooke who died in April, 1997 and left an estate conservatively valued at US$ 60 million. Assets then included the Washington Redskins football team, subsequently sold for US$ 800 million. |

| Peter Cozens | IPC Holdings. |

| Toby Crabel | Founder and CEO of Crabel Capital Holdings, Crabel Re and Bermuda-incorporated Multi-Strat Re. |

| Carl Icahn | Billionaire investor known for picking fights with corporate boards. In October 2015, he disclosed a stake in American International Group - which has dozens of Bermuda-registered companies. |

| Arthur and Jack Irving | The famous Canadian dynasty, the Irving family, has a major offshore corporate base here. A $6 billion empire, it controls huge business concerns in New Brunswick. The 125-year-old dynasty has a number of JD Irving Limited Bermuda-registered entities, and the Island became the final home for company patriarch Kenneth Colin Irving before he passed away in 1992. Since then it has been Mr. Irving's three sons JK, Arthur and Jack, all in their 70s, who have overseen the various elements of the business, which includes media, oil and energy, and forestry. The Irving family is the third richest in Canada. |

| Kenneth Jacobs |

2014 CEO of Multi-billion dollar Lazard's, Wall Street investment bank, Bermuda-incorporated and domiciled but not offering banking service in the Bermuda market. Said to be one of the few investment banks to emerge from the sub-prime mortgage meltdown unscathed. Founded as a dry goods business in New Orleans in 1847, it ranks seventh among financial advisers for announced mergers and acquisitions globally in 2009, behind larger Wall Street companies Morgan Stanley, Goldman Sachs Group Inc., Citigroup Inc. and JP Morgan Chase & Co. Operates mostly in New York, London and Paris. Lazard has 2,300 employees worldwide and approximately $143.6 billion in assets under management. Now the largest independent merger-advisory firm. Derives about half its revenue from advising on mergers and restructurings. |

| Abigail Johnson | Daughter of Fidelity Investments founder Edward (Ned) Johnson III (see below) with an estimated worth of $11.8 billion in 2013. The firm is privately held, family business with more than $3.5 trillion in assets under administration. Founded in 1946, it’s now the second-largest US mutual fund company and one of the world’s largest independent investment managers. It’s also run by two of the richest people in America — a father-daughter duo with ties to Bermuda. Abigail Johnson has a huge Bermuda home believed to be on Seabright Avenue, Hungry Bay, Paget. |

| Edward (Ned) Crosby Johnson III | American, Bermuda resident, founder and billionaire former founder and chief executive of FMR Corporation (Fidelity). He has a Somerset home. He's been very generous to Bermuda, including funding the Bermuda Underwater Exploration Institute. He is believed to be worth over US$ 6.2 billion. |

| Robin Judah | Briton resident, millionaire, supporter of the arts'He was born in Calcutta, and spent several years working in London as a stockbroker. Since moving to Bermuda in 1975, he has spent much time travelling, along with pursuing his interest in photography, an interest which has resulted in a book, "Organic Abstractions," which focused on pictures of plant life photographed with powerful lenses and a variety of film types. He donated all the profits from the book to PALS, a local cancer charity on which he sits on the board of directors. |

| Henry Keeling | XL Capital. |

| Peter R. Kellogg |  Billionaire

investor who owns Bermuda-based IAT

Reinsurance Co insurance company with his family. In 2013 they sued

the USA's Internal Revenue Service for refunds of $186 million in taxes

and interest they paid after the IRS revoked IAT’s tax-exemption

retroactively. In court documents, Kellogg and IAT claim IRS officials

were “unduly prejudiced” against them by a “politically charged

atmosphere” created by journalists and that the IRS arbitrarily timed

the revocation to maximize the taxes owed and “punish” them. The IRS

also disallowed IAT’s deduction of $1.3 million in business and

personal travel expenses for Kellogg in 2000 and 2001. IAT argues its

board properly authorized payment for Kellogg’s personal travel since

it “recognized the need for Mr. Kellogg to travel privately because of

his status including being listed by Forbes magazine.” Forbes

estimates that Kellogg, 70, is worth $2.7 billion. He ran Wall

Street’s top market maker, Spear, Leeds & Kellogg, until

engineering its sale to the Goldman Sachs Group in 2000 for $6.5

billion. Kellogg’s use of a 501(c)(15) tax exempt insurance

company to shield hundreds of millions in capital gains from tax was

first publicized in a March 2001 Forbes cover story on the proliferation

of edgy and over-the-edge tax shelters, Are

You A Chump? Back then, the law limited the tax exemption to

companies writing no more than $350,000 a year in premiums, but did not cap

the investment income or assets exempt insurers could have. Billionaire

investor who owns Bermuda-based IAT

Reinsurance Co insurance company with his family. In 2013 they sued

the USA's Internal Revenue Service for refunds of $186 million in taxes

and interest they paid after the IRS revoked IAT’s tax-exemption

retroactively. In court documents, Kellogg and IAT claim IRS officials

were “unduly prejudiced” against them by a “politically charged

atmosphere” created by journalists and that the IRS arbitrarily timed

the revocation to maximize the taxes owed and “punish” them. The IRS

also disallowed IAT’s deduction of $1.3 million in business and

personal travel expenses for Kellogg in 2000 and 2001. IAT argues its

board properly authorized payment for Kellogg’s personal travel since

it “recognized the need for Mr. Kellogg to travel privately because of

his status including being listed by Forbes magazine.” Forbes

estimates that Kellogg, 70, is worth $2.7 billion. He ran Wall

Street’s top market maker, Spear, Leeds & Kellogg, until

engineering its sale to the Goldman Sachs Group in 2000 for $6.5

billion. Kellogg’s use of a 501(c)(15) tax exempt insurance

company to shield hundreds of millions in capital gains from tax was

first publicized in a March 2001 Forbes cover story on the proliferation

of edgy and over-the-edge tax shelters, Are

You A Chump? Back then, the law limited the tax exemption to

companies writing no more than $350,000 a year in premiums, but did not cap

the investment income or assets exempt insurers could have. |

| James Kelly | Mutual Risk Management. |

| John Kessock, Jr. | Mutual Risk Management. |

| Henry and Simon Keswick | British millionaires. They founded the formerly Hong Kong based Jardines corporate empire, five of the principal companies of which fled Hong Kong in favor of Bermuda in registration and corporate domain. |

| John Werner Kluge | American billionaire, Bermuda resident. He headed the Metromedia conglomerate. His luxury yacht Virginian was once often seen in Bermuda waters, registered at the Royal Bermuda Yacht Club. |

| Charles and David Koch |

American multibillionaires, owners of privately-held Koch Industries, second-biggest privately held corporation in the USA, with many Bermuda-registered subsidiaries. |

| Todd Kozel | American millionaire owner of Bermuda-registered Gulf Keystone Petroleum, Since 2001. Cumberland House, Hamilton, c/o of Cox Hallett Wilkinson. A major oil company, explorer of Middle East and other oil, owner of Shaikan-1 well, located near the Northern Iraqi city of Dihok, and other wells. |

| Donald Kramer | ACE. |

| Ronald Lauder | Worth at least US$ 3.4 billion in 2013. He heads Bermuda registered Central European Media Enterprises Ltd. He and his brother Leonard are cosmetics heirs, via his mother Estee Lauder. |

| Stephen Lauder | Believed to be worth over US$3.1 billion. He owns Bermuda-registered companies. |

| Michael Lee-Chin |

2019. January 3. NCB Financial Group, the company that owns a majority stake in Clarien Bank, has made a bid to take a controlling interest in Caribbean region insurer Guardian Holdings Ltd. Controlled by Michael Lee-Chin, the Jamaican-born billionaire, NCB has a 50.1 per cent stake in the Bermudian bank. Mr Lee-Chin’s Portland Private Equity owns an additional 17.9 per cent stake in Clarien. On Monday, NCB’s subsidiary NCB Global Holdings, made an offer to all Guardian shareholders to buy up to 32.01 per cent of the company. The $2.79 per share offer is worth more than $207 million in aggregate. NCB already owns 29.99 per cent of Guardian, which is based in Trinidad and Tobago and offers life, health, property and casualty insurance, as well as pensions and asset management in 21 countries across the English and Dutch Caribbean. If the bid is successful, NCB would own a 62 per cent controlling interest in Guardian. The offer is conditional upon Guardian shareholders tendering sufficient shares to give NCB a more than 50.01 per cent stake and on regulatory approvals for the deal. The offer period is scheduled to close on February 7, 2019. 2017. December 19. Billionaire investor Michael Lee-Chin sees a bright future for Bermuda — a view he has backed with hard cash in the form of his purchase of a controlling interest in Clarien Bank. The charismatic Jamaican-born chairman of Canadian firm Portland Holdings is not troubled by the growing pressure being applied on the island by major countries looking to clamp down on tax avoidance. In an interview, he said he saw opportunity amid the uncertainty, guided by his long-term confidence in both the island and its wealth-management industry. And he spoke of his penchant for wealth-building opportunities at times of crisis, of moving in when other investors are moving out. On December 1, Clarien Group announced agreement on a deal that would give companies controlled by Mr Lee-Chin’s Portland group of companies a 68 per cent stake in the Bermuda company. Portland Private Equity, which initially invested in Clarien in April 2016, will hold a 17.9 per cent interest in Clarien under the terms of the deal, while NCB Financial Group will own 50.1 per cent. Edmund Gibbons Ltd owns the remainder. Speaking from Canada, Mr Lee-Chin explained the thinking behind this substantial investment. “I’m very bullish on Bermuda, because Bermuda has a phenomenal global reputation, and because its current situation has given us an opportunity to enter the market. Also, wealthy people from around the world still want to protect their assets, so there will be an opportunity to service their needs.” He said the attention focused on offshore financial centres like Bermuda from tax-hungry major countries had created an improved investment opportunity. “We are firm believers in the Chinese definition of the word crisis,” Mr Lee-Chin said. “Crisis = danger + opportunity. We can’t get the opportunity unless there is a crisis. When there is a crisis, most people focus on the ‘danger’ component, but those with long-term thinking recognize the opportunity.” Global financial institutions were pulling out of offshore centres, he said, something he described as a “kneejerk reaction” to today’s circumstances. “In five or ten years from now, the global players will want to return,” he said. “With the benefit of time they will realize that there is still a strong demand from clients to protect their assets and Bermuda has developed a reputation as a safe place to do that. The rising demand for asset protection is a long-term, secular trend and I always want to invest in a business with a rising tide that will lift all boats and will lift ours.” The island’s advantages included its British legal system, the fact that it is English speaking, has a great mid-Atlantic location, and also that it has a strong reputation for stability, he added. An example of how Mr Lee-Chin’s opportunity-from-crisis investment philosophy has worked for him came with Portland’s purchase of National Commercial Bank Jamaica Ltd in 2002. At the time, NCB had 24 per cent market share in Jamaica, where Canadian banks, one of which had a 54 per cent market share, were dominating. He recalled: “At the time we bought the bank, staff morale was low because they couldn’t compete against the Canadian banks, their IT infrastructure was outdated, inflation was about 30 per cent and the currency was depreciating. The year before we bought it, NCB made a profit of US$6 million — in the year through September 2017, it made US$150 million and now it has a 44 per cent market share. Over the 14 years, it has made about US$1.5 billion in profits and paid about US$475 million in corporate taxes.” The fact he highlighted taxes paid highlights another aspect of Mr Lee-Chin’s approach to doing business. The Portland mantra is prosperitas cum caritate, or prosper with care for people, which speaks to his desire for his businesses to “not only do well, but also do good. I want every staff member to come to work believing there is a direct connection between their efforts and the well-being of the next generation,” Mr Lee-Chin said. He personally works on developing such a community-minded culture in his businesses, he added, striving to lead by example through his own personal life and values. Mr Lee-Chin was born in Port Antonio, Jamaica in 1951 and moved to Canada in 1970 to study civil engineering at McMaster University in Hamilton, Ontario. He went into the mutual fund industry and became a financial adviser at 26. Having achieved some success, at the age of 32, he borrowed money to buy $500,000 of Mackenzie Financial stock, which appreciated sevenfold over the next four years. He then bought a small Ontario investment firm called AIC Ltd with $800,000 of assets under management — 20 years later it was managing more than $15 billion. In 2009, he sold it to Manulife. Now he is chairman and CEO of Portland, which has invested heavily in the Caribbean region, owning stakes in wealth management companies, insurers, banks, telecommunications groups and the Wallenford Coffee Company, the largest cultivator of Jamaica Blue Mountain and Jamaica High Mountain coffee. He said there were three preconditions that he looked for in potential investments. “When all three are present, that gets us excited,” he said.

The first thing Mr Lee-Chin said his investment will bring to Clarien is to bolster its balance sheet, which would in turn help the bank to bolster its asset-management and trust services, as well as strengthening the back office and front office. Asked whether the bank would be likely to add to its staff, Mr Lee-Chin said: “That will be a function of how well we do over time. If we are successful, more staff would be a natural by-product.” And the advice he would give to any budding entrepreneur? “Understand the eighth wonder of the world, as it was described by Albert Einstein — compounding,” he said. “If you don’t understand compounding, it’s difficult to lead a successful life. It’s about reinvesting and growing. Investing the experiences you had yesterday to make you stronger tomorrow. Doing the same thing over and over, versus flipping from one thing to another. Persevering, bringing forth everything you’ve learnt to this point in your life.” |

| Daniel Loeb | Hedge fund manager who founded, is the CEO and investment manager, of Bermuda-based Third Point Re in 2011. |

| John Lummis | Renaissance Re. |

| Robert Lusardi | XL Capital. |

| Hugh Lowenstein | A Bloomberg director who owns Bermuda-based Shore Capital Ltd. His lovely large property, "Jungle," in Tucker's Town, a neighbour of Bloomberg's, was sold recently to the two daughters, Emma and Georgina, of Michael Bloomberg, as first reported on February 21, 2006 by the New York Daily News. |

| Timothy Mardon | 2016.

December 11. Two men were found guilty of shooting and torturing

millionaire businessman Timothy Mardon in a raid on his UK countryside

mansion. Charlie Simms and Christopher Bergin targeted Mr Mardon,

51, after mistakenly believing he was using his Georgian property in

Essex as a large-scale cannabis factory, according to reports in the

British press. They will be sentenced at a later date.

2016. October 21. Millionaire businessman Timothy Mardon was shot in his mansion because he was mistaken for a drug dealer, a court heard. According to reports in the British press, Mr Mardon, division president at Chubb Tempest Re Bermuda, said he had barricaded himself in after hearing intruders in his Grade II-listed home in the village of Sible Hedingham, Essex, on February 6. The BBC reports that the victim, a father of two, whispered to a 999 operator that burglars were in his mansion moments before he was shot through a locked door. The raiders had mistakenly believed Mr Mardon, who is in his forties, was a drug dealer. Three men broke into the home, the report says; one denies attempted murder and aggravated burglary, and two others have denied aggravated burglary. Mr Mardon told Chelmsford Crown Court he was home alone when he awoke to the sound of voices and footsteps on his gravel drive. A man could be seen trying to force open a sash window, he said. Mr Mardon had called 999, and was still on the line to the police when he was shot, the court was told. The victim was shot after burglars broke into the house in Sible Hedingham — they fled empty-handed. A recording of the call, which lasted almost 35 minutes, was played to the jury. “Suddenly, there was a loud explosion,” said Mr Mardon, giving evidence. “I was thrown to the ground and the door burst open and the individual with the stocking over his head burst into the room wielding a gun.” The court heard the gunman screamed at him: “Where’s the weed money?” With blood pouring from the leg wound, he replied: “I don’t deal weed. I work for an insurance company.” Mr Mardon said the intruder threatened to kill his family if he was lying. Charlie Simms, 23 from Great Yeldham, Kalebh Shreeve, 24, and Christopher Bergin, 27, both from Sible Hedingham, denied charges of aggravated burglary, wounding with intent, possessing a firearm and possessing a firearm with intent to endanger life. Mr Simms also denied attempted murder. |

| James Martin, dcd | Born 1933 in England. Multi-millionaire, Information Technology consultant and author, nominated for a Pulitzer prize for his book, The Wired Society: A Challenge for Tomorrow (1977). Martin joined IBM in 1959, and since the 1980s established several IT consultancy firms. Beginning in 1981 with Dixon Doll and Tony Carter he established DMW (Doll Martin Worldwide) in London, UK, which was later renamed James Martin Associates (JMA), which was (partly) bought by Texas Instruments Software in 1991. He later co-founded Database Design Inc. (DDI), also in Ann Arbor, to promulgate his database design techniques and to develop tools to help implement them. After becoming the market leader in Information Engineering software, DDI was renamed KnowledgeWare and eventually purchased by Fran Tarkenton, who took it public. Until his death in 2013 when he drowned when swimming nearby, he lived on his own Bermuda private island, Agar’s Island. According to Computerworld’s 25th anniversary issue, he was ranked fourth among the 25 individuals who have most influenced the world of computer science. |

| Kathleen (Katie) McClendon | Her late husband Aubrey McClendon, born in 1960, died March 2016, was then worth about $1.1 billion. In 2006, he bought Castle Point in Tucker's Town, one of Bermuda's most luxurious properties, 8 acres surrounded by water on three sides, for $20.8 million, then gave it a multi-million dollar makeover to create a new main house, two guest cottages, swimming pool, small golf course complete with kiosks and pathways, and a pond. After selling Castle Point he acquired nearby Winsor House, 6 bedrooms, 32 Tucker's Town Road for $11 million. He is believed to also own 30 Tucker's Town Road. He was co-founder of Chesapeake Energy, the third largest independent producer of US natural gas. He also owned the pro basketball side Seattle SuperSonics. He and family used to fly to Bermuda via his corporate jet. He was a great nephew of former Oklahoma Governor Robert Kerr, co-founder of US oil-and-gas pioneer Kerr-McGee Corp. Mr McClendon, 56, was killed in a single vehicle crash in Oklahoma City. His car hit an embankment under a bridge. Mr McClendon’s death came a day after he was charged with rigging bids for oil and natural gas leases in Oklahoma. In September 2016 Mrs McClendon's luxury home Winsor House in exclusive Tucker’s Town was put on the market with a list price of more than $13.9 million. |

| Betty L. McMahon | Private lady, year-round resident, very wealthy. |

| Dr. Brian Mercer |

Awarded

an OBE in 1981 and elected a Fellow of the Royal Society in 1984, he was

the British founder of the international Netlon/Tensar plastic mesh

empire. He invented the majority of the process technologies used around

the world today to manufacture integrally formed oriented polymeric grid

and mesh structures. An engineer, scientist, inventor, innovator

and avid collector of contemporary European, Japanese and African art,

he relocated to Bermuda from the UK in 1994. In 1982 he married

Vivien Counsell of Bermuda. He was worth at least US$64 million. He died

in November 1998 at the age of 70. |

| Bruno Meyenhofer | Partner Re. |

| Scott Moore | Partner Re. |

| Robert Mulderig | Until late 2002, he was President of Mutual Risk Management Ltd. Bermudian. |

| Dennis Muilenburg | Chairman, President and CEO, The Boeing Company, Chicago, Il, USA. Boeing has several Bermuda subsidiaries. |

| Rupert Murdoch | Based in the USA, this media magnate uses Bermuda to base some of his holding companies for his US $ 5.6 billion fortune. He is believed to have 101 British or other companies listed as subsidiaries of his main British holding company Newscorp Investments. They include his low profile News Publishers company in Bermuda and many others in the Cayman Islands, Netherlands Antilles and British Virgin Islands. The Bermuda company was more profitable during the 1990s than any other British company. Murdoch also bases his family's £3.8 billion investment vehicle, Karlholt, in Bermuda and lists it on the Bermuda Sock Exchange |

| Lord Paul Myners | Baron Myners, CBE (born 1 April 1948) was quoted by British Newspapers on 23 March 2009 including the Telegraph and Sunday Times as in charge of the UK Government's clampdown on tax avoidance, tax evasion and tax havens as having set up his own business in Bermuda, Aspen Insurance Holdings. The newspapers intimated he earned nearly £200,000 in a year during his time as chairman of Aspen, between 2002 and 2007. He has stated he has always paid all his UK taxes and has no continuing interest in or from Aspen. He was Financial Services Secretary (a position sometimes referred to as City Minister) HM Treasury, in then-UK Prime Minister Gordon Brown's government. He had held the position since October 2008, and was made a life peer in order to permit his appointment, as he was not (and never has been) an elected Member of Parliament. He also served on the Prime Minister's National Economic Council. Myners worked in the financial sector since 1974. He has also held a number of third sector posts, including Chairman of the Trustees of the Tate Gallery and Chairman of the Low Pay Commission, all of which he relinquished on his ministerial appointment. Immediately prior to his ministerial appointment he was Chairman of the Guardian Media Group, publisher of The Guardian and The Observer newspapers, and chairman of Land Securities Group, the largest quoted property company in Europe at that time. He is a former Chairman of Marks & Spencer and Deputy Chairman of PowerGen. |

| Tom Nassif |  President and

CEO of Bermuda-registered Western Growers since February, 2002. This

former U.S. ambassador has lead the fresh produce industry into a new

era through coalition building and an aggressive approach of addressing

the key issues confronting the industry. In 1981, he was appointed

Deputy and Acting Chief of Protocol for the White House. He was promoted

to Deputy Assistant Secretary of State for Near East and South Asian

affairs in 1983, and in 1985, he received the appointment by President

Reagan to be his ambassador to the Kingdom of Morocco where he served

until 1988. Following his tenure as a U.S. ambassador, Tom worked as

chairman of Gulf Interstate Engineering in Houston, an oil and gas

pipeline company. He then worked as President of Los Alamos Land

Company, developing industrial and commercial business parks on the

U.S./Mexican border. He later became a managing partner of

Aequitas International Consulting, an international business and

political consulting company. Prior to joining the Reagan

administration, he was a partner in the Gray Cary Ames & Frye law

firm specializing in agricultural labor law. He represented the

Imperial Valley Vegetable Growers Association along with the numerous

growers and shippers throughout California and Arizona. He was one

of the first attorneys to try a case before the Agricultural Labor

Relations Board. He went on to represent growers and shippers in

their elections, contract negotiations, arbitrations, unfair labor

practice hearings and multi-employer bargaining. He received a

Bachelor of Science degree in Business Administration from California

State University, Los Angeles and his Juris Doctorate from California

Western University, School of Law in San Diego, California. He is

a recipient of the Ellis Island Medal of Honor; the distinguished Alumni

award from the School of Business and Economics, California State

University, and is an honorary Doctor of Law from California Western

University School of Law in San Diego. He was decorated by the

late King Hassan II of Morocco and the President of Lebanon for his work

on Middle East issues and served as Chairman and CEO of the American

Task Force for Lebanon. Tom currently serves on the Agricultural

Policy Advisory Committee in Washington, D.C. and is one of the three

national co-chairs for the Specialty Crop Farm Bill Alliance. President and

CEO of Bermuda-registered Western Growers since February, 2002. This

former U.S. ambassador has lead the fresh produce industry into a new

era through coalition building and an aggressive approach of addressing

the key issues confronting the industry. In 1981, he was appointed

Deputy and Acting Chief of Protocol for the White House. He was promoted

to Deputy Assistant Secretary of State for Near East and South Asian

affairs in 1983, and in 1985, he received the appointment by President

Reagan to be his ambassador to the Kingdom of Morocco where he served

until 1988. Following his tenure as a U.S. ambassador, Tom worked as

chairman of Gulf Interstate Engineering in Houston, an oil and gas

pipeline company. He then worked as President of Los Alamos Land

Company, developing industrial and commercial business parks on the

U.S./Mexican border. He later became a managing partner of

Aequitas International Consulting, an international business and

political consulting company. Prior to joining the Reagan

administration, he was a partner in the Gray Cary Ames & Frye law

firm specializing in agricultural labor law. He represented the

Imperial Valley Vegetable Growers Association along with the numerous

growers and shippers throughout California and Arizona. He was one

of the first attorneys to try a case before the Agricultural Labor

Relations Board. He went on to represent growers and shippers in

their elections, contract negotiations, arbitrations, unfair labor

practice hearings and multi-employer bargaining. He received a

Bachelor of Science degree in Business Administration from California

State University, Los Angeles and his Juris Doctorate from California

Western University, School of Law in San Diego, California. He is

a recipient of the Ellis Island Medal of Honor; the distinguished Alumni

award from the School of Business and Economics, California State

University, and is an honorary Doctor of Law from California Western

University School of Law in San Diego. He was decorated by the

late King Hassan II of Morocco and the President of Lebanon for his work

on Middle East issues and served as Chairman and CEO of the American

Task Force for Lebanon. Tom currently serves on the Agricultural

Policy Advisory Committee in Washington, D.C. and is one of the three

national co-chairs for the Specialty Crop Farm Bill Alliance. |

| Denis O'Brien | From Ireland, Chairman of the privately-owned Bermuda-registered Digicel Group. He founded Digicel in 2001 when the company launched a GSM cellular phone service in the Caribbean. He has extensive investments across several sectors including international telecoms, radio, media, property, aircraft leasing, golf and other leisure interests. He also founded Communicorp Group which owns and manages a portfolio of media and broadcasting-related companies in Ireland and eight other European countries. Digicel has extended its operations to 32 markets with over 11 million subscribers in the Caribbean, Central America and Pacific regions. |

| Kevin O’Donnell | CEO of Bermuda-incorporated RenaissanceRe Holdings. He had a $10.8 million 2018 compensation package. |

| Brian O'Hara | President of XL Capital Ltd. One of the highest paid Bermuda based chief executives among leading world commercial insurers and re-insurers. |

| Sir Christopher Ondaatje | An exhibition room at the Bermuda National Gallery is named in his honour, for the financial support he has provided. A cultural philanthropist, he helped fund an extension to London's National Portrait Gallery; and has donated thousands of British pounds to the Gulbenkian Foundation's £100,000 arts prize. Philip Christopher Ondaatje, eldest son of Philip Mervyn and Enid Doris Gratiaen, was born in Kandy, Ceylon (now Sri Lanka) on February 22, 1933. As a child, he moved to England where he was educated at Blundell's School, Tiverton. In 1956, he emigrated to Canada. He married Valda Bulins in 1959. Ondaatje lived in Canada for a number of years and built a highly successful career, first in banking, finance, and then publishing. He has three children: David, Sarah, and Janet. From a family noted for its literary achievements, once Ondaatje "retired" from the corporate world, he broke new ground as a respected writer of thought-provoking books dealing with significant political, historical and geographical events. He was president of Pagurian Press Ltd in Toronto in 1967, where he combined his financial powers and love of literature. He was also a founding partner in Loewen, Ondaatje, McCutcheon & Co. Ltd., in Toronto, from 1970 to 1988. Although he re-purchased control of Loewen, Ondaatje, McCutcheon & Co. Ltd., in 1992, he officially retired from finance in 1995, when he sold control of the company. Since then, he has devoted his time to travelling, writing and administering The Ondaatje Foundation. He was a member of the Canadian Olympic Bobsled team in 1964. He has maintained his interest in sports. He is a member of the Chester Yacht Club of Nova Scotia and the Toronto Golf Club. He is a life member and Patron of the Somerset County Cricket Club, England. He has fostered the development of learning and international understanding through The Ondaatje Foundation. He is a member of the Traveller's Club, London, England and a Fellow of The Royal Geographical Society, England. He is on the Advisory Board of Pearson College, Canada; Advisory Board Member of Lakefield College School in Canada; Governor of Blundell's School in England; as well as being an Honorary Governor of the Art Gallery of Nova Scotia. In addition, he is Honorary Fellow of the Royal Society of Literature, on the Advisory Board of the Royal Society of Portrait Painters, and a Trustee of the National Portrait Gallery. He has written eight books. He became an Officer, Order of Canada, in 1993 and has received three LL.Ds., from Dalhouise University in 1994, University of Buckingham in 2003, and Exeter University in 2003. He was made a Commander of the Order of the British Empire (CBE) in the Queen's Birthday Honours list, June 2000, and awarded a Knighthood in the Queen's Honours list, June 2003. |

| Larry Page | Lawrence Edward Page, his full tames. born March 26, 1973, is an American computer scientist and Internet entrepreneur. He is best known for being one of the co-founders of Google (along with Sergey Brin), which has Bermuda subsidiaries and has used Bermuda extensively in its international tax avoidance dealings. Page was the chief executive officer of Alphabet Inc. (Google's parent company) until stepping down on December 3, 2019. After stepping aside as Google CEO in August 2001, in favor of Eric Schmidt, he re-assumed the role in April 2011. He announced his intention to step aside a second time in July 2015, to become CEO of Alphabet, under which Google's assets would be reorganized. Under Page, Alphabet has sought to deliver major advancements in a variety of industries. On December 4, 2019 Page stepped down from his CEO position from Alphabet. Both Page and Brin will remained controlling shareholders of Alphabet. In October 2019, Page was the 9th-richest person in the world, with a net worth of $55.8 billion. Forbes placed him 10th in the list "Billionaires 2019". Page is the co-inventor of PageRank, a well-known search ranking algorithm for Google, which he wrote with Brin. Page received the Marconi Prize in 2004 with Brin. |

| David Palmer | 2003 Squash World champion. Australian, he has a home in Bermuda. |

| Don Panoz | American-born in Pittsburgh, PA, Irish tax exile, properties he owns includes Ireland's Elan Corporation with a Bermuda office; Chateau Elan group with hotels and wineries in California and Georgia; a £58 million golf and hotel complex at St. Andrew's Bay in Scotland. |

| Glenn Partridge | Mutual Risk Management. |

| Allen Paulson | Very rich, he put his Bermuda theme casino and hotel at the River Palms Resort in Laughlin, Nevada, near Las Vegas, in Bermuda shorts and filled them with Bermuda palms, plants and more. |

| John Paulson | Billionaire American, said to be worth $11 billion. founder and president of Paulson & Co. It has approximately $24 billion in assets under management and has offices in New York, London and Hong Kong. The New York-based company made headlines in April 2013 when it became one of many hedge funds to become involved with Bermuda’s reinsurance industry. Paulson’s company partnered with Bermuda-based Validus to form PaCRe Ltd., with an initial capitalization of $500 million to write reinsurance. Paulson & Co. manages PaCRe’s assets, while Validus carries out the underwriting. Mr Paulson gained fame when he made $3.5 billion in 2007 by short-selling sub-prime mortgage-backed securities as the US housing market crashed. Some described it as the greatest trade ever. In 2010, he made $5 billion. But in 2012 his flagship Paulson Advantage fund sank 35.91 percent net of fees and Paulson Advantage Plus was down a whopping 50.67 percent after fees. |

| Viscount Petersham | British, titled, worth US$ 160 million and has Halley Investment company in Bermuda. |

| 4th Viscount Rothermere | Since 1995, three years before the Hon Jonathan Harmsworth (as he then was) inherited the Daily Mail & General Trust plc empire from his father, the 3rd Viscount, the group has been controlled through Rothermere Continuation Ltd. It was incorporated and is registered in Bermuda but run from Jersey, Channel Islands. An earlier Viscount Rothermere died in Bermuda during WW2 and is buried at St. Paul's Church, Paget. |

| Anthony Petrello | This highest paid chief executive officer in the US heads Bermuda-domiciled oil drilling company Nabors Industries. His total compensation totaled a staggering $68.2 million in 2013-2014. |

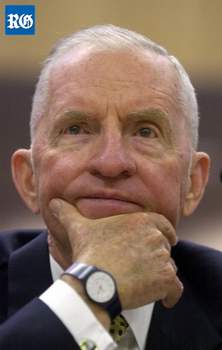

| Ross Perot |  2019.

July 10. Ross Perot, a billionaire part-time Bermuda resident and

maverick former US presidential candidate, died yesterday at home in

Dallas, Texas. Mr Perot, who had leukemia diagnosed five months ago,

was born in 1930 and was 89 at his death. He first visited the island in

1957 with his wife, Margot, while he was on leave from the United States

Navy, where he served as an officer. Mr Perot’s daughter, Carolyn

Rathjen, said the couple “thought it was the most beautiful place

they’d ever seen”. They bought a luxury beachfront property in

Tucker’s Town in 1985 and the family have been regular visitors since.

Ms Rathjen added: “The family still maintains a property on the

island. It is everyone in the Perot family’s favourite place. His last

visit was Easter, where he enjoyed sitting on his deck, transfixed by

the sound of the waves and the spectacular view.” The family said Mr

Perot loved boats, as well as windsurfing and water-skiing. Ms Rathjen

added: “Ross also loved meeting and visiting with the year-round

residents as well as the summer residents. He would always comment on

the fascinating collection of extremely interesting people with amazing

depth and interests.” Sir John Swan, a former premier, said Mr

Perot’s strong links to the island were “a win-win situation”. His

Ross Perot Foundation supported an underwater archaeology project to

work on the wreck of the Warwick, which sank off Bermuda in a

1619 storm. Mr Perot also backed other island organisations, including

the Masterworks Museum of Bermuda Art and the National Museum of

Bermuda. He also made donations to the Bermuda Aquarium for the

preservation of Trunk Island. Sir John said: “He quietly did a lot of

things that people would not know about. Ross used his plane to help

medivac people out. His wife, Margot, was a jewel. They didn’t shut

themselves away — they brought a lot of people here as friends and

guests. Ross also played that role of helping to define us in the world

of geopolitics.” Mr Perot’s 1992 run for president brought

international media attention to the island. Mr Perot ran as an

independent candidate for president in 1992 and won 19.7 million votes

in the best third-party candidate showing since 1912, when former

president Theodore Roosevelt took 27 per cent of the vote. He ran again

four years later, but was less successful. Sir John said Mr Perot’s

first presidential bid “tipped the balance of American history — he

helped dislodge President George H Bush, my dear friend”. He added:

“That was a turning point — America became busy domestically, not

internationally. Events took place after that which might have gone

differently.” Mr Perot, the founder of Electronic Data Systems

Corporation and Perot Systems Corporation, attracted international

headlines when a reef off his estate was blown up without permission so

his yacht could be moored closer to his mansion. A later investigation

by the Government found that Mr Perot knew nothing of the 1986

destruction and had not authorized it. Sir John said Mr Perot was “a

naturally tough man with a big heart”. He added that Mr Perot was

“put in the forefront” in 1979, just before the Iranian Revolution,

when two Electronic Data Systems staff were held captive in the country.

Sir John said: “He organised an operation to rescue them, which put

him in the public eye.” He added: “He was no-nonsense when he was

working and could be a lot of fun casually. He and his wife became good

friends with me and my late wife.” Sir John said: “He was a friend

of Bermuda who gave us prominence at a time when Bermuda was on the

move. “These are the type of people we can benefit from, that take our

message overseas in their sphere of influence.” He added: “I extend

my sympathies to his family and to Margot in particular.” Mr Perot is

also survived by the couple’s five children. 2019.

July 10. Ross Perot, a billionaire part-time Bermuda resident and

maverick former US presidential candidate, died yesterday at home in

Dallas, Texas. Mr Perot, who had leukemia diagnosed five months ago,

was born in 1930 and was 89 at his death. He first visited the island in

1957 with his wife, Margot, while he was on leave from the United States

Navy, where he served as an officer. Mr Perot’s daughter, Carolyn

Rathjen, said the couple “thought it was the most beautiful place

they’d ever seen”. They bought a luxury beachfront property in

Tucker’s Town in 1985 and the family have been regular visitors since.

Ms Rathjen added: “The family still maintains a property on the

island. It is everyone in the Perot family’s favourite place. His last

visit was Easter, where he enjoyed sitting on his deck, transfixed by

the sound of the waves and the spectacular view.” The family said Mr

Perot loved boats, as well as windsurfing and water-skiing. Ms Rathjen

added: “Ross also loved meeting and visiting with the year-round

residents as well as the summer residents. He would always comment on

the fascinating collection of extremely interesting people with amazing

depth and interests.” Sir John Swan, a former premier, said Mr

Perot’s strong links to the island were “a win-win situation”. His

Ross Perot Foundation supported an underwater archaeology project to

work on the wreck of the Warwick, which sank off Bermuda in a

1619 storm. Mr Perot also backed other island organisations, including

the Masterworks Museum of Bermuda Art and the National Museum of

Bermuda. He also made donations to the Bermuda Aquarium for the

preservation of Trunk Island. Sir John said: “He quietly did a lot of

things that people would not know about. Ross used his plane to help

medivac people out. His wife, Margot, was a jewel. They didn’t shut

themselves away — they brought a lot of people here as friends and

guests. Ross also played that role of helping to define us in the world

of geopolitics.” Mr Perot’s 1992 run for president brought

international media attention to the island. Mr Perot ran as an

independent candidate for president in 1992 and won 19.7 million votes

in the best third-party candidate showing since 1912, when former

president Theodore Roosevelt took 27 per cent of the vote. He ran again

four years later, but was less successful. Sir John said Mr Perot’s

first presidential bid “tipped the balance of American history — he

helped dislodge President George H Bush, my dear friend”. He added:

“That was a turning point — America became busy domestically, not

internationally. Events took place after that which might have gone

differently.” Mr Perot, the founder of Electronic Data Systems

Corporation and Perot Systems Corporation, attracted international

headlines when a reef off his estate was blown up without permission so

his yacht could be moored closer to his mansion. A later investigation

by the Government found that Mr Perot knew nothing of the 1986

destruction and had not authorized it. Sir John said Mr Perot was “a

naturally tough man with a big heart”. He added that Mr Perot was

“put in the forefront” in 1979, just before the Iranian Revolution,

when two Electronic Data Systems staff were held captive in the country.

Sir John said: “He organised an operation to rescue them, which put

him in the public eye.” He added: “He was no-nonsense when he was

working and could be a lot of fun casually. He and his wife became good

friends with me and my late wife.” Sir John said: “He was a friend

of Bermuda who gave us prominence at a time when Bermuda was on the

move. “These are the type of people we can benefit from, that take our

message overseas in their sphere of influence.” He added: “I extend

my sympathies to his family and to Margot in particular.” Mr Perot is

also survived by the couple’s five children.

In the 1992 and 1996 US Presidential elections he won 19 percent of the popular vote. He founded the Reform Party in USA. He's worth at least US$ 3.5 billion in 2013. He and his son, Henry Ross Perot, own lavish side by side Bermuda homes in Tucker's Town. His own property is "Vertigo. " Ross Jr. has "Caliban" on 2.86 acres overlooking Waller's Bay and Surf Bays, with various buildings. In August 2006, Ross Sr's guests included US Cabinet Secretary Jim Nicholson and America's leading wine importer John F. Mariani, Jr. Bermuda-based Parkcentral Global Hub is his family trust. Steven Blasnik, president of Parkcentral Capital Management LP and manager of the Perot family's money since 1992, and others formed Parkcentral Global in 2002. |

| Henry Ross Perot | Son of the above, worth about $1.4 billion. |

| Marion Macmillan Pictet | American, Bermuda resident, runs Cargill Inc. and once owned Perot's Island in the Great Sound. She is descended from William W Cargill, who started with one-grain elevator in post-Civil War Iowa. |

| Hasso Plattner | Formerly Chairman of SAP, owner of 1st over the line Morning Glory in a recent Newport to Bermuda Race. Lives at "Sea Crest" Shore Lane, Tucker's Town. |

| Mikhail Prokhorov |

Russian billionaire. Half owns Renaissance Capital, an investment bank whose holding company is in Bermuda |

| Patrick Rafter | Two-time U.S. Open Tennis Champion and Wimbledon runner-up. Has a home in Bermuda. |

| Jim Ratcliffe | British billionaire who owns Ineos Aviation (Bermuda), Since 2007, founded in 1998 by him. Owns a fleet of corporate jets registered in Bermuda with the Aviation Register. Believed to be part of the Swiss-headquartered Ineos Group which has both a very substantial (and Scotland's only) oil refinery and chemical plant in Grangemouth, Scotland. In October 2013 the powerful Unite union there refused to accept lower or frozen pay and pensions for its members as a condition of keeping the plants open as they were losing money, Ineos announced it would shut down the plant completely, the union caved in and agreed the Ineos terms to keep the plant open, without strikes. |

| Robert Reale | Annuity & Life |

| Dennis Reding | ACE. |

| David & Simon Reuben/Rueben Brothers |

British billionaires worth about £14 billion in 2018, whose London real estate empire alone includes the Piccadilly Estate, Millbank Towers, Burlington Arcade, Arena Racing Company, London Oxford Airport, a chain of pubs, London Heliport, Merchant Square and much more. A Reuben Brothers company is Bermuda-incorporated. |

| William Riker | Renaissance Re. |

| Mitt Romney |

Republican candidate for US President November 2012 elections. Estimated to be worth about $250 million, he and/or his wife and family have several Bermuda-based offshore entities. |

| Hans-Joerg Rudloff | A frequent visitor to Bermuda, he was chairman of Barclays Capital - the investment banking division of Barclays Bank; the director of Bermuda-based Marcuard Capital (Bermuda) Ltd; and is a board member of the enormously wealthy (about US$2.7 billion) Bermuda-based Thyssen-Bornemisza Group. It cost US$100 million to settle its grievances in Bermuda in 2001-2002 |

| Sackler family | One of the

world's richest US and British families. Descendants of Isaac

Sackler and his wife Sophie (née Greenberg), Jewish immigrants to the

United States from Galicia (now Ukraine) and Poland, who established a

grocery business in Brooklyn. The couple had three sons, Arthur,

Mortimer, and Raymond Sackler who all went to medical school and became

psychiatrists. They were often cited as early pioneers in medication

techniques which ended the common practice of lobotomies, and were also

regarded as the first to fight for the racial integration of blood

banks. In 1952, the brothers bought a small pharmaceutical company,

Purdue Frederick. Raymond and Mortimer ran Purdue, while Arthur, the

oldest brother, became a pioneer in medical advertising and one of the

foremost art collectors of his generation. He also gifted the majority

of his collections to museums around the world. After his death in 1987,

his option on one third of that company was sold by his estate to his

two brothers who turned it into Purdue Pharma. The pharmaceutical firm Napp,

which they own and control, owns

Bermuda-based Mundipharma and the family also own and control

Bermuda-based Purdue Pharma. Purdue Pharma, introduced OxyContin

in 1996, a version of oxycodone re-formulated in a slow-release form.

Heavily promoted, oxycodine is seen as a key drug in the emergence of

the opioid epidemic.]

Elizabeth Sackler, daughter of Arthur Sackler, claimed that her branch

of the family did not participate in or benefit from the sales of

narcotics. While Arthur Sackler was criticized in the wake of the crisis

by some for pioneering marketing techniques used to promote non-opiods

decades earlier, Professor Evan Gertsman said in Forbes magazine" it is

an absurd inversion of logic to say that because Arthur Sackler

pioneered direct marketing to physicians, he is responsible for the

fraudulent misuse of that technique, which occurred many years after his

death and from which he procured no financial gain. In 2018, multiple

members of the Raymond and Mortimer Sackler families, Richard Sackler,

Theresa Sackler, Kathe Sackler, Jonathan Sackler, Mortimer Sackler,

Beverly Sackler, David Sackler, and Ilene Sackler, were all named as

defendants in suits filed by numerous states over their involvement in

the opioid crisis. The family was first listed in Forbes list of

America's Richest Families in 2015.

2018. May 15. A drug manufacturer has come under fire in Britain for allegedly diverting $1.35 billion through Bermuda to avoid taxes. A report in London’s Evening Standard said pharmaceutical firm Napp has funneled cash through its Bermuda-based Mundipharma offices for more than 25 years. Napp, which manufactures painkiller OxyContin among other drugs, and Mundipharma are controlled by the billionaire Sackler family. The UK’s NHS Digital, which provides data to the National Health Service, said Sackler drugs make up 68 per cent of the volume of the oxycodone market in England and 29 per cent of the entire $356 million opioid market. The newspaper report, published last week, said the company manufactured drugs in Cambridge, England, and has paid taxes on drugs sold to the NHS. The report added sales to other parts of the world were routed through Mundipharma’s office on Par-la-Ville Road in Hamilton. The story said: “This would have allowed profit to be taken on the island nation, where no tax is payable. According to our sources, Mundipharma bought the drugs from the UK at one price and sold them to Mundipharma entities for a lot more — keeping the profit made in Bermuda. However, the products were shipped directly from the UK to the country where they were sold and did not go anywhere near Bermuda.” Napp’s turnover for international sales totaled $182 million in 2015. The report said: “Over 25 years, our sources said, the amount of profits diverted to Bermuda from Mundipharma Europe and Australasia was well over £1 billion. If the 2015 profit had been taxed in the UK, where the drugs are manufactured, it would have attracted corporation tax of 20 per cent, which equates to £30 million.” Over the 25 years the scheme has operated, this may add up to the avoidance of hundreds of millions of pounds in corporation tax. Bermuda’s role was reduced in 2015 due to changes in UK law, with profits being repatriated through the UK. The report quoted a tax expert who said the process used by Napp was not illegal or considered tax evasion “provided the transfer pricing arrangements with Bermuda could be commercially justified”. The unidentified expert said: “One way to add value is for the offshore company to hold the intellectual property and charge a fee for this, but in this case it appears the IP for OxyContin is held by Napp in the UK, and their larger trademark portfolio is held by Mundipharma AG in Switzerland. So it is hard to see, at least on the facts supplied, what activity in Bermuda added the value to justify the higher pricing.” The expert added that it was possible that the company entered into an advance pricing agreement with HM Revenue and Customs. The expert said: “Before 2015 this was relatively easy, as such arrangements were often difficult for HMRC to challenge successfully. The introduction of diverted profits tax in 2015 made it harder for multinationals and this may be why the arrangements changed so radically in 2016.” In a joint statement, Napp and Mundipharma said they had a long history of paying taxes in the UK, including $90.7 million between 2013 and 2016. The statement said: “Napp and Mundipharma independent associated companies based in the UK are transparent in the disclosure in their public accounts of their dealings with independent associated companies and in their dealings with HMRC. We follow HMRC’s guidance in full. We pay all taxes that we owe.” 2017. The £2 million Sackler Courtyard was unveiled at the V&A in the UK, emblazoned with a huge Sackler nameplate as well as a plaque honoring the late Mortimer Sackler, his third wife Theresa and all seven of his children. Oxford University alone was given £11 million by the family. |

| Wafic Said | Billionaire. A Syrian-Saudi Arabian businessman living in Monaco and Paris. Born 21 December 1939, in Damascus, Syria. Owns a huge exempted investment holding company, Said Holdings Ltd. incorporated and registered in Bermuda. It has investments in Europe, North America and the Far East and diverse portfolios, which include fixed income, quoted equities, hedge funds, private equity and real assets including real estate. Saïd started his business career in banking in 1963 at UBS Geneva. In 1969, he established a project development and construction management business in Saudi Arabia. The following two decades, during the period when Saudi Arabia was building its infrastructure, saw his group handle some of the largest public sector projects in the Kingdom. He became a billionaire through his connections with the Saudi royal family, acting as an advisor and consultant on many major infrastructure, industrial and defence related projects including the multi-billion dollar Al-Yamamah arms deal, which was considered controversial at the time. Is also heavily involved with Bermuda-registered Magna Holdings. |

| Gary Scofield | Annuity & Life. |

| Hon. Christopher Sharples | He lives with his wife and mother, Baroness Sharples, at multi-million dollar Tideway, 19 Lone Palm Drive, Point Shares, Pembroke Parish, Bermuda. It received Bermuda’s residential building design award in 2001. The Hon. Christopher Sharples and mother Baroness Sharples are the son and wife respectively of Governor Sir Richard Sharples who was assassinated in Bermuda in 1974 with his aide-de-camp, Captain Hugh Sayers, Welch Guards, British Army. They are buried side by side at St. Peter's Church in the Town of St. George. Lady Sharples was made a Baroness by the British Government in London soon afterwards. |

| Kevin Sheehan | 2014 CEO of

Bermuda-registered Norwegian Cruise Line (and Norwegian Cruise Line

Holdings). Its purchase of Prestige Cruises International could provide

a major boost to Hamilton and St George's in the years to come. The

firm's CEO, Kevin Sheehan, told The Royal Gazette that Bermuda was the

perfect market for Prestige's high end, luxury cruise liners. And he

said that Norwegian would look at bringing more of the smaller liners

from the Prestige fleet into Hamilton and the East End once the deal was

sealed. "Once we get through the transaction Prestige's ships are

already scheduled for the next 12-18 months," Mr Sheehan said.

"But this acquisition could enable us to think more about Bermuda

especially given that both Oceania and Regent (which fall under

Prestige) deal with the high end of the market. Both of these brands, we

would think, would have customers who would favour Bermuda as a

destination. Many of the smaller, high end ships would be perfect for

Bermuda. They could come into Hamilton for a couple of days and maybe St

George's for a couple of days. But we do not own the company at this

point. It is something we would look at in the future. It's certainly an

option we would consider." An acquisition agreement between

Norwegian and Prestige was signed on September 2, 2014. The $3 billion

transaction is subject to regulatory approvals and other customary

closing conditions before it is expected to close in the fourth quarter

of 2014. At present two Norwegian cruise lines; the Breakaway and the

Dawn, are regular callers to Bermuda, while Prestige owns upper-premium

cruise operator Oceania Cruises and luxury cruise operator Regent Seven

Seas Cruises. The company operates eight ships, with about 6,500 berths.

At present a handful of Prestige's ships visit Bermuda, but those that

do are just occasional callers. "We would be open to bringing more

of the smaller ships into Bermuda. it seems like the perfect market,

" Mr Sheehan said. "We continue to be excited about Bermuda as

a destination."

NCL's Kevin Sheehan. See above story |

| James Sherwood | American, worth at least US$ 80 million. He heads the Bermuda registered company Sea Containers Ltd. It has substantial real estate, hotel and ferry holdings in Europe and elsewhere. He was the major investor in the reconstituted Orient Express in the late 1970s and spent $32 million on it. |

| Sir Martin Sorrell |

CEO and founder Sir Martin Sorrell of WPP, world's largest advertising company Bermuda-incorporated but based in the UK, was paid £70 million in 2015, one of the biggest payouts for a British company, sparking anger among shareholders. In April 2017 in its Annual Report it announced it will cut his pay to just over £13 million by 2021 after a shareholder revolt. In April 2018 he resigned as CEO but the BBC announced he would be paid £45 million annually in 2018, down from £70 million earlier.. |

| George Soros | Hungarian born, British, American, worth an estimated $19 billion. Chairman of several Bermuda-incorporated Soros companies. Via funds, he holds shares in Bermuda based IPC Holdings, a subsidiary of which is catastrophe insurer International Property Catastrophe Reinsurance Company Ltd. Reportedly gives away more than $600 million a year, once planned to give away all of his wealth before his death. |

| Robert Stigwood estate |