Click on graphic above to navigate the 165+ web files on this website, a regularly updated Gazetteer, an in-depth description of our island's internally self-governing British Overseas Territory 900 miles north of the Caribbean, 600 miles east of North Carolina, USA. With accommodation options, airlines, airport, actors, actresses, aviation, banks, beaches, Bermuda Dollar, Bermuda Government, Bermuda-incorporated businesses and companies including insurers and reinsurers, Bermudians, books and publications, bridges and causeway, charities, churches, citizenship by Status, City of Hamilton, commerce, communities, credit cards, cruise ships, cuisine, currency, disability accessibility, Devonshire Parish, districts, Dockyard, economy, education, employers, employment, environment, executorships, fauna, ferries, flora, former military bases, forts, gardens, geography, getting around, golf, guest houses, highways, history, historic properties, Hamilton, House of Assembly, housing, hotels, immigration, import duties, internet access, islands, laws, legal system and legislators, main roads, marriages, media, members of parliament, money, motor vehicles, municipalities, music and musicians, newcomers, newspaper, media, organizations, parks, parishes, Paget, Pembroke, performing artists, residents, pensions, political parties, postage stamps, public holidays, public transportation, railway trail, real estate, registries of aircraft and ships, religions, Royal Naval Dockyard, Sandys, senior citizens, Smith's, Somerset Village, Southampton, St. David's Island, St George's, Spanish Point, Spittal Pond, sports, taxes, telecommunications, time zone, traditions, tourism, Town of St. George, Tucker's Town, utilities, water sports, Warwick, weather, wildlife, work permits.

By Keith Archibald Forbes (see About Us).

Gibb's Hill Lighthouse, Southampton Parish

|

See end of this file for all of our many History files |

Bermuda's Royal Gazette newspaper is not published on Sundays or Public Holidays.

September 30. Europe is set to bail out its “zombie banks” within the next few months, a banking industry expert told an audience of asset management professionals in Bermuda yesterday. Lawrence McDonald, who witnessed a bank’s collapse from the inside when he was vice-president of distressed debt at Lehman Brothers when it folded in 2008, said Deutsche Bank’s situation now is eerily similar to his former employer’s plight shortly before its demise. Mr McDonald, the head of global macro strategy at ACGA and a contributor to US business channel CNBC, was speaking at the World Alternative Investment Summit at the Fairmont Southampton. Deutsche Bank’s shares took a pummeling after the US Justice Department announced its intention to fine Germany’s biggest bank $14 billion over matters relating to the sub prime mortgage crisis. This has rekindled fears over the bank’s stability. Mr McDonald said the problems were similar in some other big European banks. “Deutsche Bank has about $16 billion of equity and $162 billion of debt,” Mr McDonald said. “In the US, Hank Paulson [the former US Treasury Secretary] got the big bank CEOs around a table in 2008 and said ‘you’re taking this money’. They took the pain and did the bailouts. That did not happen in the same way in Europe and this has been building up for years. The truth has been coming out one drop at a time. Soon six or eight banks will be forced to sit around the table. We expect a major recapitalisation to happen within the next three months. Zombie banks were not capable of financing the needs of an EU economy of more than 500 million people." The German government has stated it does not intend to give Deutsche Bank any help, but Mr McDonald brought up charts that he said suggested that matters were coming a to a head. One graph showed that when the market believes the Deutsche Bank’s debt is getting riskier, the same applies to Germany’s debt — an example of “credit spread contagion”, Mr McDonald said. There were clear signs that banks trusted each other less when lending between themselves — as occurred in the run-up to the global financial crisis — as signified by a widening spread between the Libor rate and the Fed Funds rate, he added. Mr McDonald, the author of the New York Times bestseller A Colossal Failure of Common Sense: The Inside Story of the Collapse of Lehman Brothers, specializes in identifying political and systemic risk leading to actionable trade advice. He said the US presidential election was another source of market risk and that he had seen a clear correlation between Donald Trump’s fortunes and stock market volatility. At times when Mr Trump has risen in the polls, the VIX, a measure of S&P 500 Index volatility sometimes known as the “fear index” has risen too. The big banks, in particular, were seen as having a lot to lose if the Republican Party candidate wins in November. Regardless of whether Mr Trump takes the White House, it is possible that over the coming weeks the perceived likelihood of him winning may increase, offering trading opportunities. Another strong risk emanates from Asia and particularly China. Credit default swaps on major Asian financial institutions — indicating their perceived level of riskiness — had risen sharply just before the past two double-digit declines in the S&P 500 Index, Mr McDonald said, and they could likewise be an indicator of future dips. Years of low interest rates had left investors craving yield, he said, and he saw a “hot bubble” inflating in the commercial real estate sector and strong demand for high-yield bonds. “I had lunch with a fund manager from BlackRock, who told me that German and Japanese insurance companies are buying up high-yield bonds,” Mr McDonald said. “He said it’s like nothing he’s ever seen.” That was one of the market-warping effects of negative interest rates that exist in both Europe and Japan, he added. Central banks were creating potentially “catastrophic, unprecedented bond volatility” by keeping rates so low for so long, he said. The markets were functioning strangely, he warned, with an unusually high correlation — about 23 per cent — between stocks and bonds, which traditionally move in opposite directions. The conference, which was opened by Michael Dunkley, the Premier, also featured Ross Webber, the chief executive officer of the Bermuda Business Development Agency, who said: “Bermuda’s economy is on the upswing — the recession is behind us.” Mr Webber said much work had been done to bolster Bermuda’s asset management industry and that was now bearing fruit. Centaur Fund Services set up an office on the island earlier this year and he added that other managers and service providers were making plans to set up in Bermuda. Mr Webber said there was a tendency among overseas politicians and media to lump all offshore financial centres together as an “axis of evil” and use them as a scapegoat. Some offshore jurisdictions deserved their bad reputation for ignoring the changing regulatory landscape and embracing secrecy — but Bermuda was not one of them, he said. Pointing to Bermuda’s success in the international reinsurance markets and its lengthy record of reliable claims-paying, he added: “Bermuda is a place to raise capital, not hide it. The likely exit of Britain from the European Union makes Bermuda even more attractive as a jurisdiction for fund managers," Mr Webber added, particularly as the island has applied for “passporting” rights to gain free access to EU markets.

September 30. Premier Michael Dunkley will not be travelling to Britain for the upcoming Conservative Party Conference, Cabinet Office announced today. The Premier was scheduled to travel this weekend to the event, to network and meet with UK Cabinet members. However, those meetings were not confirmed, so Mr Dunkley will instead aim to schedule any meetings during the Overseas Territories Joint Ministerial Council Meeting, in Britain at the end of October. The Bermuda London Office’s planned Birmingham networking session for next Monday has now been cancelled and confirmed attendees notified. Bermudians living, working and studying in Britain are instead encouraged to attend a networking session on October 31, at the London Office, located at 6 Arlington Street, London, SW1A 1RE. They will have an opportunity to have face-to-face dialogue with the Premier. Environment minister Cole Simons will attend next week’s Conference and plans to hold discussions with UK officials and organisations about Bermuda’s marine environment. For more information about the London Office networking session, e-mail eventslondonoffice@gov.bm or call 020-7518-9900.

September 30. A business perspective on the digital changes impacting the world now and in the future, has been presented by Microsoft to executives in Bermuda. The first Microsoft CXO event on the island was an opportunity for the technology company to present innovations and solutions that are helping its partners navigate the shifting digital landscape. The event was given the title “Bermuda Empowered”. Microsoft speakers Ricardo Agosto, Rita Picarra and Renatto Garro presented aspects of how the company is working to “empower businesses for the digital transformation”. Monique Ragbir, marketing lead for Microsoft WI, said: “Digital transformation is not the future, it is happening today in companies large and small.” She explained that in a survey half the respondents said that by the end of 2016 they expect their company to be completely digitized; by 2019, this number should have reached 83 per cent. “It’s not a traditional large scale, one-off transformation, it is a pivoting to a mindset of ongoing innovation, updates and continual growth. The changes are not going to happen overnight, but every journey starts with a single step.” The event was held at the Hamilton Princess yesterday. Many of the attendees were senior managers and executives. Ms Ragbir said digital transformation may be considered the next industrial revolution, “providing the catalyst for new businesses, models, products, services and experiences, that impact not only businesses, but society as a whole. To date it has been largely focused on operational efficiency, but the potential is much greater. Digicel business is the creation of new businesses designed by blurring the physical and digital worlds If your company is to survive you must adapt these thinkings and practices.” Ms Ragbir said there were three key messages. “The first is that during this digital transformation we have to innovate for the future and stay a step ahead to meet the transformation for our customers, and Microsoft is here to help you with that. The second is we will simplify the transformation for you the customers and focus on key areas: engaging your customers, empowering your employees, atomizing processes and transforming your products. The third message was to show how Microsoft’s solutions will offer greater choice and flexibility that are easy to get started on and are affordable and powerful”. Mr Agosto, Microsoft’s territory manager for Bermuda, spoke in more detail about the digital transformation and how it is reflected in changing business models from Uber, to Amazon’s ambitions to achieve deliveries with drones, and Microsoft’s shift from software licensing to subscriptions. Ms Picarra, financial controller for Microsoft LatAm New Markets, demonstrated efficiencies and high-performance analytics that can be achieved through the company’s Power BI data tool. Other speakers were representatives of Microsoft partners in Bermuda, namely Fireminds, Arcos Technologies, Inova Solutions, Emergence Corporations, and SoftwareONE. The companies sponsored the event, alongside Bermuda Microsystems Group and The Certus Group. Microsoft viewed the forum as part of its investment to help guide its customers to go digital. In a statement it said the agenda was to “address practical concerns such as how to use technology to empower employees, engage customers and local technology partners will feature presentations offering localized perspectives on digital transformation and process optimization”.

September 30. Confidence in Bermuda’s economy is marginally up, according to a poll commissioned by The Royal Gazette. The Global Research survey this month found 30 per cent of people had faith in the direction the economy was heading — up from 25 per cent three months ago, but still short of the 36 per cent achieved last December. In keeping with trends from previous polls, those most likely to be happiest with the economy were whites (51 per cent, compared with 15 per cent of blacks), men (34 per cent, compared with 26 per cent of women) and people aged over 65 (44 per cent, compared with 14 per cent of those aged between 18 and 34). The economy also retained its place as the leading issue facing Bermuda. Some 53 per cent of people named the economy or unemployment as the island’s top concern, down from 58 per cent in March. Education (14 per cent), crime (12 per cent) and racism (6 per cent) retained second, third and fourth positions, respectively. The telephone survey of 402 registered voters took place between September 6 and 12, and has a margin of error of +/- 5 per cent. Yesterday, this newspaper reported how, last year, Bermuda experienced inflation-adjusted growth for the first time since 2008 thanks to expansion in international business and retail.

September 30. Attorney-General Trevor Moniz aims to modernize Bermuda’s dated bribery and fraud laws when the House of Assembly resumes in November. Mr Moniz attended a conference from September 20-22 in the Turks and Caicos Islands alongside his counterparts from other Overseas Territories and Crown Dependencies. A variety of topics were discussed at the conference, also featuring UK Solicitor-General Robert Buckland, relating to the rule of law and administration of justice in the OTs. Mr Moniz said that he hoped to bring Bermuda into line with the United Nations’ Convention Against Corruption and the Organisation for Economic Co-operation and Development’s Anti-Bribery Convention. “Our bribery and fraud laws are very old and outdated. We’re trying to bring them up to modern standards, so we can comply with these conventions and have them extended to Bermuda,” he told The Royal Gazette. Mental health legislation in the OTs was also discussed at the conference, again aiming to reform antiquated laws as well as ending the use of prisons as safe havens for those with mental health conditions. “We don’t have a top-class psychiatric unit,” Mr Moniz said. “We need one, but it’s more economically feasible in larger jurisdictions. It’s a problem of scale, and we’re seeking answers to that.” Regarding the UN Convention for the Elimination of Discrimination Against Women, the Attorney-General said there was “no major problem” in Bermudian law to prevent it from being extended to the island. “There may be one or two small areas where we have to tweak the legislation, and that’s in process,” he added. Child safeguarding, human rights and government procurement were among the other issues discussed at the 25th Conference of Attorneys-General from UK Overseas Territories and Crown Dependencies, which looks likely to be held in Bermuda next year. Mr Buckland also welcomed developments in legislation for same-sex marriage in St Helena, the British Antarctic Territory, Jersey and Guernsey. Mr Moniz admitted that Bermuda has had its “struggles” finding a satisfactory route to extend mandated legal rights to same-sex couples. “We have an obligation under the European Convention to establish a legal framework for same-sex partners,” the Attorney-General said. “We have not done that, not for a lack of trying, because we haven’t been able to get anything through the House of Assembly. It’s a work-in-progress for us.”

September 30. Ewart Brown, the former Premier, may claim privilege and refuse to answer questions when called as a witness at the Commission of Inquiry. The second day of the tribunal began yesterday with an unsuccessful application from his lawyer, Jerome Lynch QC, for a subpoena issued to Dr Brown to be set aside. Mr Lynch asked whether it was fair for the commission to compel someone to give evidence in relation to matters “which we know he is being investigated about by police”. And he said it was possible he would advise his client to claim privilege in court if he was compelled to attend. “What I’m not prepared to do, as you will understand, is allow anybody to subject themselves to the dangers that inevitably exist when there’s an extant police investigation,” Mr Lynch said. Dr Brown has been the subject of a long-running police inquiry since June 2011, costing at least $2.2 million of public funds and prompted by allegations of corruption made under oath in the Supreme Court by disgraced financier David Bolden. Mr Lynch said that placed the former Premier in a “very different capacity from everyone else [giving evidence] in this inquiry. He has spent five years being investigated on the back of a witness, a convicted liar, having made assertions about corruption,” said the lawyer. “He has never been arrested, he has never been questioned, never been asked to provide a single piece of evidence to the police. They have made it clear that they are continuing their investigation and it concerns the very matters with which the [Commission of] Inquiry is concerned.” The commission rejected the request for the subpoena to be set aside but adjourned the date for the former Premier to give evidence to Monday, November 28, to give him and his lawyer what Mr Lynch called “sufficient time to prepare”. Yesterday’s hearing heard that Dr Brown was told in a letter in June that he “may” be asked to give evidence to the tribunal and that a box of documents was delivered to a house guest at his Bermuda residence the following month, when he was out of the country. Mr Lynch said Dr Brown did not see the “750 pages” of material, covering six topics, until August 19 and on August 25, Mr Lynch wrote to the commission to ask for eight weeks to consider it. He said Dr Brown would have needed to look beyond the material and it was “not something, we submit, that could be done in short order”. During a testy hour-long exchange with commission chairman Sir Anthony Evans, he said the commission had “not exactly been speedy itself”, having originally been given a 20-week timeframe to conduct its work when it was formed in February, a deadline since extended to the end of this year. “You yourself told the public yesterday that there was a vast amount of material to deal with,” he said. “You have a team of lawyers. He doesn’t have a team of lawyers. He has me. It wasn’t an unreasonable request.” Mr Lynch said the commission refused the request and issued a subpoena to Dr Brown on August 31. Sir Anthony said in his opening statement to the tribunal on Wednesday that some of the government contracts to be scrutinized by the tribunal were also under investigation by police. “With regard to our limited resources, I pause here to note that the commission has had no investigators at our disposal, forensic or otherwise,” the chairman said on Wednesday. “Our budget did not provide for this. I should add that we have not had access to any police files of any matters, which are [or have been] under active police investigation, although we have been made aware that some of the contracts into which we are inquiring are [or have been] the subject of those investigations.” Mr Lynch said if the commission knew which contracts the police were looking at, and if they were the same as the ones it planned to probe, the commission should not require Dr Brown to give evidence. He said Dr Brown had “rights in relation to privilege” and Sir Anthony replied: “I only know of one and I won’t mention which one it is.” The commission, which heard evidence yesterday afternoon from the first of its 20 witnesses, Cabinet Secretary Derrick Binns, will conclude its hearings by Tuesday, October 11. It has until December 31 to report its findings. Sir Anthony pointed out to Mr Lynch that by adjourning Dr Brown’s evidence, there would be a “penalty” to him as the panel may already have drawn some conclusions after hearing the evidence of the other witnesses.

September 30. Paula Cox objected to a proposal by Ewart Brown to hire an overseas company as consultants on a $400,000 a year retainer, the Commission of Inquiry heard yesterday. The idea for the Ambling International Consultancy contract was brought to Cabinet by the Premier and Minister of Tourism and Transport, according to commission lawyer Narinder Hargun. Mr Hargun said: “The Premier told Cabinet that the Minister of Finance had been consulted and did not support the memorandum. This is one of the rare situations where the minister was not in favour of this engagement. The finance minister told Cabinet she had difficulty supporting the memorandum because the contract had not been put to tender. Her objection was that there was no tender.” All government contracts worth $50,000 or more require Cabinet approval and the Ambling deal was agreed, despite Ms Cox’s objection. Mr Hargun said Eddy Benoit, from Atlanta-based Ambling, “was known to Cabinet” and the focus of the consultancy would be the Department of Works and Engineering. “It is difficult to see what the Ministry of Tourism has to do with it,” said the lawyer. “It’s very marginal.” The $400,000 contract with Ambling was signed by Department of Tourism chief William Griffith. “They will receive this [amount] whether any consultancy services are received or not, this is the retainer,” Mr Hargun said. During yesterday’s hearing, he detailed another Ministry of Tourism contract under scrutiny by the commission, involving US-based company GlobalHue, for $11.4 million a year. The Auditor-General criticised the company’s contract for not being tendered in a report released in February 2009 and soon after it was renewed for another two years. GlobalHue used a sub agent called Cornerstone Media to place broadcast ads and the Auditor discovered that Cornerstone’s “mark-up” when it billed GlobalHue was sometimes as much as 186 per cent. Both contracts will be probed further during the commission’s witness hearings over the course of the next week and a half.

September 30. A “concerted effort” to change the culture within the civil service regarding financial rules has been made of late, Cabinet Secretary Derrick Binns told a hearing yesterday. Giving evidence to the Commission of Inquiry, Dr Binns said: “The attitude and the culture and the means to monitor and achieve compliance with financial instructions has changed considerably of late. The decision to do so has been taken by the civil service executive.” He said he could not say for certain if it was the first time such measures had been taken but added: “I can say we understand the issues and we have made a concerted effort to change the culture and the regime.” The island’s top civil servant was giving evidence on the second day of the commission’s public hearings at St Theresa’s Church Hall in Hamilton, which are expected to last until October 11. The tribunal is probing the misuse of public funds between the years 2009 and 2012, as identified by Auditor-General Heather Jacobs Matthews in a report last year. Dr Binns is the first witness to have been questioned by commission lawyer Narinder Hargun and the panel itself, comprising of chairman Sir Anthony Evans, Fiona Luck, Kumi Bradshaw and John Barritt. Today, fellow senior civil servants Marc Telemaque, Anthony Manders and Cherie Whitter are due to give evidence. Mr Hargun asked Dr Binns about two projects from the time when he was permanent secretary at the Ministry of Works and Engineering: the Heritage Wharf cruise ship pier at Dockyard and the Dame Lois Browne-Evans court and police building in Hamilton. Mr Hargun said the pier — which cost taxpayers $60 million — was one of the largest civil engineering projects undertaken on behalf of the Government of Bermuda, yet was managed by the Ministry of Tourism and Transport, rather than the Ministry of Works and Engineering, which had the expertise. Dr Binns said it was sometimes necessary for projects to be outsourced and the pier project was on a tight deadline, as it needed to be ready for the visit of a large cruise ship in April 2009. He said in such circumstances it wasn’t unusual to engage outside help, which was what Tourism and Transport did, in relation to the pier. Mr Hargun referred to Dr Binns’s witness statement to the commission, in which he said he was asked by Mr Telemaque to sign a contract between the Bermuda Government and Correia Construction regarding the pier. “If the project was being managed by the Ministry of Tourism, why couldn’t they sign it?” asked Mr Hargun. Dr Binns replied that his Ministry had been asked to review the contract, as it had reviewed such contracts before, and that he “sought to provide the assistance” required by the Ministry of Tourism. In relation to the court building contract, Dr Binns told how he was “unable to ascertain” the rationale of Public Works Minister Dennis Lister when the latter rejected a recommendation from ministry technical officers on which firm should get the $70 million contract. Mr Lister preferred a different firm, Landmark Lisgar, and told Cabinet he was satisfied it was the right company for the job, the hearing heard, without telling them about the recommendation from the technical officers. Landmark Lisgar was awarded the contract. “There are many decisions that are made within the Ministry based on advice but for a project as complex as this it would be uncommon for the Minister not to accept the advice,” said Dr Binns. He was asked by commission chairman Sir Anthony Evans if it would be helpful if ministers were obliged to put recommendations from technical officers regarding contracts before the Cabinet. “I see no harm in that,” replied Dr Binns. The tribunal continues.

September 30. A Pembroke man has been arrested in connection with a series of armed robberies, including two in the past week. A police spokesman said the 40-year-old was assisting police with three separate incidents. Among them are the robbery at Wok Express on North Street on Sunday night and a robbery on Tuesday night at Pasta Basta on Elliott Street. In the incident on Sunday, a man wearing a scarf covering part of his face, brandished what appeared to be a firearm at Wok Express and stole an unknown quantity of cash. He then made good his escape, east along Parsons Road on a motorcycle cycle. Meanwhile, in the incident on Tuesday, a black male entered Pasta Basta, brandishing what appeared to be a firearm and demanded money from staff. The suspect stole an unknown quantity of cash and left the scene on a motorcycle. The same suspect is also speaking to police about a separate robbery at the same Elliott Street restaurant which occurred on March 13. In that incident, a black male entered the restaurant with what appeared to be a firearm and demanded money from staff. He was described as being about 6ft tall, wearing a red mask, black pants and brown top. He reportedly stole an unknown quantity of cash and left the scene on a white motorcycle in a northerly direction on Washington Street North. The police spokesman said: “A file is being prepared for Department of Public Prosecution charge approval and it is anticipated that the suspect will be appearing in Magistrates’ Court on Monday.” Anyone with additional information about the incidents or who may have witnessed the robberies are urged to contact Dave Greenidge on 247-1185 or the confidential Crime Stoppers hotline on 800-8477.

September 29. Mexico Infrastructure Finance maintained that an $18 million guarantee issued by the Corporation of Hamilton for a hotel project was valid, during a Supreme Court hearing. The municipality claimed during a hearing on Monday that it was not empowered to issue the guarantee for the Par-la-Ville hotel project because it was not for “municipal purposes”. However, addressing the court yesterday, Lord David Pannick, QC, representing MIF, said the project was intended to benefit the city and its residents, and as a result the guarantee had a municipal purpose. “The guarantee in this case was an essential part of the scheme,” he said. The dispute revolves around a guarantee issued by the corporation to Par-la-Ville Hotel and Residences Ltd, a developer who intended to erect a luxury hotel on the present site of the Par-la-Ville car park, to help them secure a bridging loan. While the developer subsequently received the loan from MIF, it soon defaulted and the funds have not been recovered, leaving the Corporation of Hamilton on the hook. The courts later approved a consent order from the corporation, but the municipality has applied to have the order set aside on the grounds that the guarantee itself was “ultra vires” — beyond the power of the corporation to issue. Barrister Michael Beloff, QC, representing the corporation, further argued that amendments intended to allow the guarantee had been ineffective as they had not touched on the requirement of municipal purposes. Making submissions yesterday, Lord Pannick, however, noted that the amendments had included a reference to guarantees in a section of the Municipalities Act which would allow the body to act with legislative approval for “specific purposes”. “The legislation expressly recognizes that the corporation may, with legislative approval, give a guarantee for specific purposes,” he said. “At the very least, it recognizes that the power exists, otherwise it would not state the corporation is entitled to guarantee for specific purposes. The section of the legislature after amendment is that broad powers are enjoyed if the minister approves or if legislative approval is conferred.” He also argued that the court should, where possible, interpret the legislation in a manner which would not frustrate the intentions of legislators. In this case, he said the amendments were meant to remove the perceived barrier preventing the corporation to issue the guarantee. “It is well established that, as far as it is possible, the court will seek to advance the purposes of the legislature, to arrive at a conclusion that secure the legislature’s intentions,” he said. While Mr Beloff had noted the terms of the guarantee itself had stated it was intended for “private and commercial purposes”, Lord Pannick maintained that it was undisputed that the corporation sought to move forward with the project to benefit the municipality. “There is no dispute that the corporation entered into this guarantee because it believed it was for the benefit of the local area and its inhabitants,” he said. “There is no suggestion whatsoever in any of the evidence that there was a private purpose. They were not doing this to make some private financial gain.”

September 29. Tourism figures were up 7.9 per cent in August, according to statistics released yesterday by the Ministry of Tourism and Transport. Some 94,555 people visited Bermuda for leisure this August, compared to 87,646 last August and 80,267 in August 2014 — representing a rise of 17.8 per cent in two years. The biggest increase was for cruise ship visitors which went from 59,562 in August 2014 to 70,854 in August 2016. Air vacation and leisure visitors increased from 20,705 in August 2014 to 23,701 in August 2016. Out of the total number of air visitors to Bermuda in August 2016, the most common purpose of their trip to Bermuda was vacation and leisure which made up 77 per cent of the total, while 12 per cent of air visitors were visiting friends and relatives, and business travel made up 10 per cent. Business arrivals also increased year-on-year, with 3,042 people arriving in August compared to 2,977 during the same period last year. The figures show that one of the largest increases in total air arrivals came from the United States, with 20,926 visitors coming to Bermuda from the US in August 2014 and 24,242 coming to the island from the US in 2016. Meanwhile, there was a 46.7 per cent increase year over year in the total number of air arrivals from Asia for the month of August. Hotel occupancy was also on the rise, with 76.9 per cent occupancy in August compared to 71 and 67.3 per cent in August 2015 and 2014 respectively. Michael Fahy, the Minister of Tourism, Transport and the Municipalities, said he was impressed and encouraged by the results, adding: “It really bodes well for next year with the America’s Cup getting under way and provides us with strong momentum heading into the off-season in Bermuda. “There is much still to do but these numbers are certainly an indication that Bermuda is getting traction once again with travelers. I want to congratulate the Bermuda Tourism Authority for their efforts to attract visitors to our shores — efforts which are clearly paying off.”

September 29. Ground was officially broken this afternoon on the Azura Boutique Hotel and Residences at the former site of the Surf Side Beach Club. Addressing the media and invited guests, John Bush, of the Clearwater Development Group, said he believed the project, which will allow local and international buyers to purchase units and rent them out in whole or in part through the Azura hotel management company, will be a sustainable success. “Our desire is to create something that is exciting to our visitors, but is also a sustainable hotel property, and we believe the business model we have here will make it very successful. I am, and my colleagues are, passionate about Bermuda. We believe in it. We love it. Tourism wants to work, tourism will work and I can tell you tourism will work on this site.” The resort will initially include 18 hotel residences with up to 46 hotel rooms, some of which he said have already been purchased despite only coming onto the market days ago. The first phase of the project will also include a spa and a poolside restaurant, while planning approval has already been granted for a second phase of development, bringing the number of potential hotel keys to 69. A statement by Clearwater Development Ltd explained: “One major benefit of purchasing in this development is that the hotel concessions that have been granted allow owners participating in the hotel programme to receive the very attractive purchase pricing, have land tax waived for five years, and enjoy duty free pricing on furniture, fixtures and fittings. And for overseas buyers, the property license fee is waived. The first order of business for the development team is under way and includes landscape and common area enhancements, expansion and improvements to the pool and restaurant area, and major restoration and reinforcement of the cliffs and beach area, including renovations to the sea walls and construction of elevated and protected beach areas. This initial scope of work will be completed over the next three to four months.” Many of the existing buildings on the site are set to be retained and “thoroughly renovated”, but three small buildings are set to be demolished and replaced by a new three-bedroom villa. An additional two story building, containing five 3-bedroom villas, is also planned, featuring vegetated “green” roofs to increase green space for guests. Mr Bush added that the development team behind the project was entirely Bermudian, along with the lender and 80 per cent of investors. “This is a locally done project, and we are excited about it,” he said.

September 29. Eight universities and colleges from the Atlantic Canada region are to visit Bermuda next week to meet with prospective students. The region is made up of the four most eastern Canadian provinces of Nova Scotia, New Brunswick, Newfoundland and Labrador and Prince Edward Island. This visit builds on previous visits and events that have attracted Bermudian students to institutions throughout the Atlantic Canada region. Katherine Cross, visit coordinator and assistant registrar at Dalhousie University, said: “We’re excited to return to Bermuda and help local students learn more about their postsecondary options in Atlantic Canada. “From actuarial science and business to social sciences, engineering and health related programmes, the eight institutions who will be visiting Bermuda on this trip are well positioned to help students thrive in their postsecondary studies and achieve their academic and career goals.” Students, parents and community members are invited to attend the Atlantic Canadian Education Fair next Monday at Bermuda College, from 6.30pm to 8.30pm. Postsecondary representatives will also be visiting a number of high schools on the island during their visit. Recent St Francis Xavier University psychology graduate Shandae Simons said she loved her undergraduate experience in Canada and is now studying occupational therapy. “Some of my most cherished memories were made during my four years at St Francis Xavier,” she said. “Looking back at my experience, I can truly say that although St Francis Xavier is a university it feels more like one big family; one that I am proud to be a part of.” Atlantic Canadian institutions offer a wide variety of programmes to prepare students to enter graduate studies or begin their careers in Bermuda or abroad. “After graduation, I returned to Bermuda, worked full-time at Ernst and Young and started studying for the chartered accountant designation,” said Caroline Berlo, a 2013 graduate of St Francis Xavier. I passed my CA exams in 2015 and was promoted to an audit senior position at EY. I’m proud to be part of one of the firm’s biggest audit teams.” Matt Coelho, a two-time graduate of Dalhousie University, said he felt at home on campus. “I chose Dal because I loved the programme, it was close to Bermuda and it was sort of a familiar environment,” he said.

September 29. Tropical Storm Matthew has been upgraded to Hurricane Matthew, the National Hurricane Centre announced this afternoon. The hurricane, which is not a current threat to Bermuda, is located 150 miles north-northeast of Curacao, has maximum sustained winds of 75mph and is heading west at 17mph. The NHC’s five-day forecast sees Matthew heading towards Jamaica, Haiti, the Dominican Republic, Cuba and the Bahamas early next week. Bonaire, Curacao and Aruba are continuing their Tropical Storm Watch for Matthew, the fifth hurricane of the season. According to The Jamaica Observer, the country’s National Meteorological Service has issued a severe weather alert as it closely monitors Matthew.

September 29. “Please stop using us as a rubbish dump”. That’s the plea from staff at The Barn who are regularly forced to spend $200 a week to get rid of broken and unusable items that have been left outside the Devonshire thrift shop. Manager Barbara Brown told The Royal Gazette that donations dropped off outside the store gates by members of the public on days when it was closed were often ruined by the rain. “It’s important to stress that we really appreciate all the items that people donate to us. But the trouble we are increasingly facing now is that people are using us as a dump. The key thing for us is that items are firstly usable and secondly in a decent condition. We have had some people literally leave bags of rubbish outside our gates, and some mornings when we arrive we can’t open the gate because people have piled up bags, mattresses and all sorts of other things outside.” Mrs Brown added: “People seem to think that they can drop off electronic goods like hoovers and DVD players that do not work, mattresses with springs sticking out of them and dirty underwear. But we do not have the time or the expertise to repair these kind of donations. As a result we have to hire trucks to pick up dumpsters to take to Tyne’s Bay and also take electronic goods that are beyond repair up to the airport dump. It’s costing us about $200 a week at the moment.” The Barn on Devon Spring Road is open for donations on Tuesday, Thursday and Saturday mornings between 9am and 11am. Mrs Brown says that one of the major challenges faced by her team of volunteers is the build-up of donations and bags that are left on days when The Barn is closed. She urged members of the public to drop off donations on mornings when the store was open. “We are extremely grateful to people who take the time to drop off items that we can then sell on, we are just asking people be a little understanding. Dropping the items outside the gates on days when we are closed just makes even more work for us and the bags are often so heavy we can’t even pick them up.”

September 29. The 2016 book Border Crossing Brothas: Black Males Navigating Race, Place and Complex Space is a book that should resonate with many people here, if only because it tells the stories of our own. Bermudian Ty-Ron Douglas, an assistant professor and affiliate faculty member of the Black Studies programme at the University of Missouri, is the author. The book draws on the experiences and journeys of 12 black Bermudian males, sharing their educational experiences in places such as the school house, in barbershops, local sports clubs, the Church and the neighborhood. Ty-Ron Douglas is a keynote speaker at the 5th Annual International Colloquium on Black Males in Education, which opens Wednesday. He will sign copies of his book at Brown & Co at 6.30pm on Tuesday.

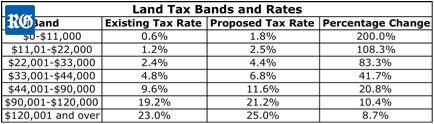

September 29. July’s rate of inflation jumped to the highest level since January as an increase in land tax and electricity bills pushed the cost of living higher. Consumers paid 1.6 per cent more in July 2016 than they did a year before for the basket of goods and services included in the Consumer Price Index, the Department of Statistics said today. The level of inflation rose 0.8 percentage points from the 0.8 per cent measured in June 2016. The biggest driver of the increase was the rent sector, in which prices rose 1.4 per cent, due primarily to changes in land tax that resulted in residents paying more on average. Electricity bills climbed as the fuel adjustment rate rose for the first time in 12 months, resulting in a 4.3 per cent increase in fuel and power costs. The food sector edged up 0.3 per cent in July following on from its 0.2 per cent rise in June. Key contributors to the increase were fresh oranges, up 4.3 per cent, eggs, up 3.4 per cent, and tinned soup, up 2.5 per cent. Transport and foreign travel also cost 2.5 per cent more, as the average cost of air fares shot up 13.9 per cent from the month before. Average prices at the pump fell 2.1 per cent from June, however. The basket of goods and services that cost $100 in April 2015 now costs $102.20.

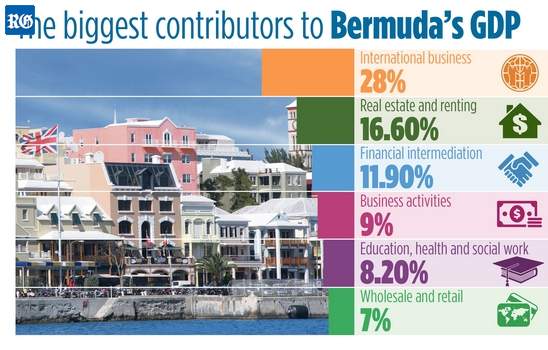

September 29. Bermuda’s economy grew in real terms last year for the first time in seven years, according to government statistics released today. Gross domestic product — the value of all the goods and services the island produces — was $5.9 billion last year, up 4 per cent compared to 2014. After being adjusted for inflation, the increase was 0.6 per cent, the first time real GDP has risen since the 1.1 per cent increase in 2008. The rise in economic growth translated into a 4.1 per cent gain in GDP per capita which was measured at $96,018 per person in 2015. The growth was broad based, with 13 of the total 15 industries recording growth in value added, led by international business and retail, which produced the largest increases by dollar value. The figures also provided evidence that the massive makeover of the Hamilton Princess Hotel and America’s Cup-related projects boosted the economy, as the construction sector’s contribution to GDP grew by 6.7 per cent. International business activity represented 28 per cent of the island’s GDP and the sector’s value added rose 5.3 per cent from 2014 to $1.66 billion, driven by increases in wages, salaries and benefits, and investment compensation. Ross Webber, chief executive officer of the Bermuda Business Development Agency, said: “This is a very encouraging milestone. The fact that this is real GDP growth, led by international business, is reassuring and underscores the BDA’s mission — to raise GDP and create jobs. Through the BDA Concierge Service, we are certainly seeing more companies establishing in the jurisdiction across industry sectors, and we will continue our efforts to keep the trend on track.” After international business, the next biggest sector was real estate and renting activity, which climbed 2.1 per cent to $983.55 million. The wholesale, retail trade and repair services segment saw strong growth, with value added increasing 10.9 per cent. Within this industry, growth in value added was led primarily by sales and repairs of motor cycles, up 43 per cent, sales of motor vehicles, up 32.3 per cent, and sales by food stores, up 12.9 per cent. Grocery stores’ sales increases were probably helped by the reduction of the 10 per cent Wednesday discount to 5 per cent, as of March last year. Value added by businesses selling household appliances and equipment rose 27.2 per cent, while businesses trading in hardware, paints, glass and other construction materials increased 11.9 per cent. Value added for hotels and restaurants was 3 per cent higher in 2015. Restaurants saw a $7.3 million, or 7.1 per cent, improvement over the previous year, despite a 2 per cent decline in visitor arrivals last year. Public administration’s contribution to GDP fell 1.2 per cent, as the Bermuda Government’s reductions in wages, salaries and employee overheads continued. The statistics also highlight the sectors that pay out the most in employee compensation. International business leads the way, having paid out $1.44 billion to its staff, while financial intermediation, including the banking industry, is in a distant second with $356.4 million and business activities in third with $347.4 million. Public administration forked out $327.4 million in compensation. The figures also show the value of the wholesale and retail ($272 million), hospitality ($232.9 million) and construction ($124.5 million) sectors as major employers. The summary from the Department of Statistics also provided information on “gross national disposable income”, defined as “the income that can be used by households for consumption or savings as well as the income not distributed to owners of equity for non-financial and financial corporations”, which increased 3.4 per cent year over year to $6 billion. Gross national savings were measured at $1.9 billion, representing a 6 per cent increase year over year. Of the total savings, $704.2 million was spent on investment in capital goods.

Top sectors: the biggest sources of economic activity in 2015 (Graphic by Byron Muhammad)

September 28. American International Group, Hamilton Insurance Group (Hamilton), and affiliates of Two Sigma Investments, LP today announced they have reached agreement to form Attune, a technology-enabled platform to serve the $80 billion US small to medium-sized enterprise (SME) commercial insurance market. The agreement follows a memorandum of understanding the three companies signed in April to form this partnership. Terms of the deal were not disclosed. In a joint statement today, the venture partners said Attune will use data science and advanced technology to meet the risk needs of small businesses. Partnering with retail and wholesale insurance brokers, agents and other intermediaries, it will provide small business owners with a broad, flexible range of products. The ultimate goal of Attune is to streamline risk submission and the insurance underwriting process for small businesses. Attune will combine Hamilton’s small business knowledge and underwriting expertise with AIG’s scale, extensive data, and longstanding distribution network. Technology and data science capabilities for Attune will be developed and managed by Two Sigma, a company that applies its technology platform and artificial intelligence capabilities to reveal unique data insights. Two Sigma co-founder David Siegel said: “At Two Sigma, we have shown how a technology and data-science platform can help discover value in the world’s economic data. The insurance industry is ripe for change, and we are excited to partner with AIG and Hamilton on this new venture.” Hamilton chairman and CEO Brian Duperreault, who will serve as chairman of the board of Attune, said: “Attune has the potential to transform underwriting in the SME market, and what we learn in building Attune’s technology platform can be applied to any size risk. We’re on the cusp of true innovative change in our industry. Being able to partner with AIG and Two Sigma — leaders in their respective industries — makes this venture all the more exciting.” Peter Hancock, AIG CEO, said of the venture: “Attune represents an important way forward for the insurance industry as it adapts to the disruptive forces of data analytics and the powerful technology supporting it. By combining our industry expertise, knowledge, and capabilities with the advanced data technology of Two Sigma, we play a critical role in determining how these forces will shape the way we work with our brokers and agents in the SME segment. We will gain an even deeper understanding of how to harness the power of analytics for the benefit of our company, our clients, and our shareholders.”

September 28. Economic theory is rooted in the assumption that people generally behave rationally when they make financial decisions — but in reality, it seems we don’t. Companies that strive to understand humans’ irrational quirks will be better positioned to sell their products and services, according to a behavioural economics expert who spoke at an insurance conference yesterday. Evelyn Gosnell, of Irrational Labs, who specializes in the psychology of money, said: “We like to think of ourselves as rational, but we are heavily influenced — although in predictable ways. There was growing evidence that suggested that even when we have the information needed to make a rational financial decision, we are still likely to choose irrationally. Selling ideas that challenge the basis of economic theory gets a mixed response in the business world. Some get the behavioural economics bug as soon as they hear about it. Others are slower to catch on. The many common assumptions out there are a strong force to work against." Irrational Labs is a non-profit organisation that applies behavioural economics — why we do what we do — to product, marketing and organizational design problems. In her keynote presentation yesterday at the Bermuda International Life and Annuity Conference at the Fairmont Southampton, Ms Gosnell showed delegates some of the evidence that humans are just not logical when it comes to money. She highlighted studies concluding that even though most people said they wanted financial security and could specify three things they could do to help achieve it, they tended to stop short of actually acting on this knowledge. "Some of our irrationality is driven by our tendency to think of money in relative rather than absolute terms, Ms Gosnell said. She gave the example of seeing a pen in a store priced at $25, but then hearing that the same pen was available for $7 loss in a store five minutes’ walk away. Most people would take the walk and buy the cheaper pen, she said. However, if someone was buying a $450 suit and was told they could purchase the identical item for $7 less at a nearby store, they would be less likely to make the effort — even though the $7 saving was the same in each case. She then described “mental accounting” the process by which we categorize money into specific “buckets”. She gave the example of the city of Boston’s tax rebates. When the rebate was described as “bonus income”, the recipient was more than twice as likely to spend it as when it was described as “withheld income”. The same process of mental accounting can happen, she said, when funds for the future are specifically labeled. For example, it would be harder to withdraw money from “Dave’s College Account” than it would be from “Savings”. Our process of evaluation can also be easily influenced. She gave the example of a choice of annual subscription options for The Economist. When there was a straight choice between online access at $59 and print plus online at $125, most people plumped for online only. However, when a third option — the print edition only for $125 — was added, 84 per cent of people chose print plus online. Effectively the third option had indicated a value for the print edition in the readers’ minds and had made the print plus online deal look like a bargain. The perception of value is often tied to effort. If it is apparent that you or someone else has put in a lot of effort into creating a product, then we are more likely to value it highly than if the effort involved is not so apparent — internet service, for example. Ms Gosnell highlighted one of the challenges for the life and annuities industry — that it is selling something whose benefits are far in the future. Our tendency is to discount, sometimes heavily, for time, she added. It is among the reasons people struggle to save enough for retirement. The BILTIR conference was a one-day event which also featured sessions on the capital markets, cyber security in the insurance sector, predictive analytics and the state of the reinsurance market.

September 28. Actions carried out by the board of trustees of Port Royal Golf Course were “straightforward fraud”, the Commission of Inquiry heard yesterday. Commission chairman Sir Anthony Evans made the remark after the tribunal heard how the board of trustees paid $10,000 of public money to a company awarded a contract for goods, so the company could in turn pay that money to board of trustees member Delano Bulford as a “finder’s fee”. The board, according to commission lawyer Narinder Hargun, then agreed to ask the company to produce an invoice which did not mention Mr Bulford’s name in case the transaction was “frowned upon by the Auditor-General”. Sir Anthony said: “It’s straightforward fraud.” He asked Mr Hargun on whom the fraud was committed and the lawyer replied: “If it’s an inappropriate payment, then it’s fraud on the Consolidated Fund [the public purse].” At the time, Progressive Labour Party MP Zane DeSilva was a member of the Port Royal board; businessman Wendell Brown was its chairman. In her special report into the Port Royal project in 2014, Auditor-General Heather Jacobs Matthews wrote that the board of trustees authorised and paid $10,000 in excess of the invoiced price to a company which was awarded a contract for goods. Ms Matthews stated: “The board of trustees’ minutes indicate that this payment was to enable the company to pay a ‘finder’s fee’ of $10,000 to a board of trustees member. It is not clear what relationship, if any, the board of trustees member had with the company to earn such a payment.” The redevelopment of Port Royal was one of a number of historic government projects which came under scrutiny at yesterday’s hearing; others included the emissions testing centres for TCD, the Heritage Wharf pier at Dockyard and the new Magistrates’ Court and police building. The four-person panel heard from Mr Hargun about massive project cost overruns, ministerial interference, failures to follow financial rules by civil servants and lack of Cabinet approval for contracts. The lawyer spent yesterday setting the stage for a series of witness hearings, due to start today, which will explore the mishandling of public funds from 2010 to 2012, as outlined by the Auditor-General in a damning report which prompted Michael Dunkley to form the Commission of Inquiry. Although some of the projects occurred before the financial years covered in the Auditor’s report, Sir Anthony said the commission took the view they were relevant to provide context for what was to follow. He said the commission also believed it was right to include the current airport redevelopment to find out the current culture within government in relation to complying with financial instructions. The Government has formally objected to the inclusion of the airport deal and is expected to make a submission to the commission today at 10am, when the hearing resumes at St Theresa’s Church Hall in Hamilton. Yesterday, the panel heard how the Ministry of Works and Engineering was repeatedly “sidelined” when it came to managing capital projects during the years that Ewart Brown was Minister of Tourism and Transport. Mr Hargun said despite Works and Engineering having the expertise to ensure quality and value for money for the public, major projects were delegated to the Ministry of Tourism and Transport which had no experience and, in turn, paid external consultants to manage projects and hire contractors. The lawyer said the result was the Government ceased to have “any control” over those projects and costs spiraled, with no proper checks and balances in place. The tribunal also heard how Derrick Burgess, when public works minister, went against the advice of technical officers on which firm should be contracted to build the Magistrates’ Court and police building. Mr Hargun said Mr Burgess failed to share the recommendation of the technical officers with Cabinet, instead outlining his own choice, Landmark Lisgar, which was ultimately chosen. Sir Anthony said in his opening statement that the commission had identified the senior civil servants and ministers responsible for some of the contracts being probed by the tribunal — but not all had been willing to provide witness statements. “Each person identified was requested to make a witness statement,” he said, adding that free legal advice was also offered. A few declined to produce any witness statement before the hearing.” The commission has the same powers as the Supreme Court to subpoena witnesses and relevant documents. Witnesses can claim the same legal privileges available to them in court. Sir Anthony said if a witness refused to give evidence or produce documents, the commission would hear legal submissions on how to proceed. Referring to such refusals, he said: “To a limited extent, that’s already occurred.” Lawyer Venous Memari is representing members of the Bermuda Public Services Union, including Cabinet secretary Derrick Binns, financial secretary Anthony Manders, Accountant-General Curtis Stovell and permanent secretaries Marc Telemaque, Cherie Whitter and Randy Rochester. Those attending the hearing in the public gallery for Sir Anthony’s opening statement yesterday included Mr DeSilva, Opposition backbencher Walton Brown, BPSU general secretary Ed Ball and BIU president Chris Furbert.

September 28. The island’s first Commission of Inquiry in more than 15 years is due to properly get under way today, but the scope of the investigation has yet to be determined after the Bermuda Government formally objected to the inclusion of its controversial airport redevelopment deal. The commission issued a statement yesterday highlighting that Government had not made written objections regarding the airport contract sooner; it said it would now have to consider those objections before making a decision. The statement noted a press conference held on Friday on the subject by acting attorney-general, senator Michael Fahy, and said the formal objection was received “subsequent” to that. “Government has now followed proper procedure which the commission established for those who wish to make objection to any matter which the commission proposes to examine as part of its inquiry. Written objections to the inclusion of the airport were received yesterday from the Attorney-General’s Chambers on behalf of the Government. In accordance with our published rules, the commission must deliberate on those objections and proposes to make a decision shortly. Because the issue has been raised publicly, the commission also wishes to state publicly that no undertaking was ever given to the Government that we would not inquire into the airport project.” The independent Commission of Inquiry was formed by Michael Dunkley in February this year with a remit to inquire into issues raised by a damning report from the Auditor-General on how civil servants mismanaged public funds during the financial years 2010, 2011 and 2012. The scope of the commission, as outlined by the Premier in the terms of reference, was to “inquire into any potential violation of law or regulations, including the Civil Service conditions of employment and code of conduct, financial instructions, and ministerial code of conduct, by any person or entity, which the commission considers significant and [to] determine how such violations arose”. Mr Dunkley said the Auditor-General’s “disturbing” report necessitated the Commission of Inquiry, since it concluded that official government financial controls were regularly overridden or ignored and those responsible were “seemingly immune” to any sanctions. Four commissioners — Sir Anthony Evans, Fiona Luck, John Barritt and Kumi Bradshaw — were appointed by the Premier and they announced in June they would look beyond the years 2010 to 2012, probing into government contracts awarded both before and after that period. Commission chairman Sir Anthony told the first public hearing that the Government’s airport redevelopment contract would be investigated, along with contentious projects of the past. Mr Dunkley gave the commission power to consider “any other matter” which it considered relevant to the scope of its inquiry, but Mr Fahy told Friday’s press conference that the LF Wade International Airport project — the subject of much criticism from the Progressive Labour Party and the People’s Campaign — was not within that scope. He said: “Government has been consistent in its representations to the commission that the LF Wade project is not within their terms of reference or scope. The commission has persisted in requesting documents and has asked civil servants to provide information about the airport project.” Mr Fahy added: “Civil servants need not reply to requests for information that is not relevant to the terms of reference.” The Minister said the Government asked the commission to hold off on requesting documents until the commercial close of the $250 million project with the Canadian Commercial Corporation. But the commercial close was delayed so the commission, according to Mr Fahy, went ahead with its requests to civil servants. This is the second time an oversight body has sought to get the Government to disclose further details about its agreement with CCC. The bipartisan parliamentary Public Accounts Committee has repeatedly tried — and failed — to obtain nine schedules which explain how the deal would work. Mr Fahy said on Friday: “Certain documents relating to the project are protected by public interest immunity. They are contract documents subject to negotiation ... They contain information and documentation that is proprietary to the developer. Until the negotiations are finalized, Government cannot release those documents.” A recent Supreme Court judgment considered how far the commission would be able to stray from its terms of reference, with Chief Justice Ian Kawaley finding that “there can be no serious contention that the COI has been given a roving brief to investigate whatever it sees fit”. He said the commission’s legal mandate was “primarily anchored to the financial years 2010, 2011 and 2012” and matters in the Auditor’s report. “This finding may (not must) have implications for the range of documents falling outside this time period which can properly be sought. It may also have implications, as I observed in the course of the hearing, for the COI’s evinced intention of investigating the current airport project.” The commission has until the end of the year to submit its final report and recommendations. It is budgeted to cost taxpayers more than a half a million dollars. The most recent commission of inquiry in a British Overseas Territory was prompted by allegations of government corruption in the Turks and Caicos Islands in 2008/9 and resulted in the British Government imposing direct rule. Later, former Premier Michael Misick was arrested on suspicion of corruption and his trial is still ongoing. The last commission of inquiry in Bermuda was opened in August 2000 to look at serious crime and was sparked by the botched investigation and prosecution of the case against two men accused of the July 1996 murder of schoolgirl Rebecca Middleton, although the commission’s terms of reference did not mention the Middleton case. Previous commissions looked at the drugs squad and the last-minute postponement of the referendum on independence. Until December 2014, only the Governor could form a commission of inquiry in Bermuda. Legislation was passed that month giving the Premier power to do the same. Today’s public hearing is at 10am at St Theresa’s Church Hall, Laffan Street, Hamilton.

September 28. The Corporation of Hamilton yesterday argued that its $18 million guarantee of the Par-la-Ville Hotel project was not valid, during a hearing in the Supreme Court. At the in-chambers hearing before Puisne Judge Stephen Hellman, the municipality claimed that despite amendments to the Municipalities Act, it could not legally issue the guarantee for the project as it was not for a “municipal purpose”. However, lawyers for Mexico Infrastructure Finance LLC, the firm that issued the loan to the project developer, argued that the use of municipal land and the approval of the relevant minister meant that the guarantee — and a subsequent consent order from the corporation — was valid. They further argued that it was an abuse of process to raise the matter so late in proceedings. The case relates to a bridging loan issued by MIF to Par-la-Ville Hotel and Residences Ltd who sought to erect a luxury hotel on the site of the Par-la-Ville car park. In order to support the project, the Corporation of Hamilton agreed to guarantee an $18 million bridging loan from MIF. Amendments to the Municipalities Act were approved purportedly to allow the corporation to issue the guarantee using municipal land. The guarantee was issued and the bridging loan approved, but the developer subsequently defaulted on the loan and efforts to recover the funds have been unsuccessful. While the corporation subsequently approved a consent order acknowledging the guarantee, it has since filed an application to set aside the consent order on the grounds that it was not valid, as the guarantee had not been valid. Barrister Michael Beloff, QC, representing the corporation, said that while such a ruling might be “unattractive”, he added: “The case law is crystal clear that this is the inevitable consequence.” He argued that the project was not for a municipal purpose as required by statute and, as a result, the guarantee for the project was “ultra vires” — beyond the corporation’s legal power. He told the court that the guarantee itself stated that it was intended for “private and commercial purposes”, which he described as the antithesis of municipal purposes. And Mr Beloff argued that even though property at the heart of the project was corporation land, this did not necessarily mean that the project had a municipal purpose. “They cannot do something not on their land, but it doesn’t mean everything connected to their land is of a municipal purpose,” he said. On the subject of the amendments intended to allow the guarantee, Mr Beloff said that while the amendments extended the corporation’s ability to issue guarantees, they did not touch on the municipal purpose requirement. And he refuted the suggestion that the application was an abuse of process, stating that the issue was only recently identified and the corporation acted as soon as practicable. “They thought that the problem had been cured,” he said. “Until this was raised, no one thought there was any problem. We didn’t delay once we knew there was this point and we had ministerial approval.”

September 28. NEW YORK (Bloomberg) — Former American International Group (which has many Bermuda-incorporated subsidiaries) chairman Maurice “Hank” Greenberg says he got personally involved in an “insignificant” business deal at the insurance giant 18 years ago to teach some managers a lesson. Now, that deal is part of a fraud claim that could prevent the 91-year-old from serving as an officer of a public company. Greenberg took the witness box yesterday in a Manhattan courtroom to defend against claims that he and former AIG chief financial officer Howard Smith orchestrated two sham deals to hide the insurer’s financial condition from shareholders. One was a transaction involving Capco Reinsurance Co, allegedly to hide more than $200 million in underwriting losses from an auto-warranty business started by Greenberg’s son, Evan, who is now chief executive officer of Chubb Ltd. Greenberg testified that he became aware of serious problems in AIG’s auto-warranty business as early as 1998. He said he began taking steps to correct them the following year, while disagreeing with New York Assistant Attorney General David Nachman’s characterization that he was a “hands-on CEO”. “This was a small part of our business,” said Greenberg. “It was insignificant. It wasn’t so insignificant that you tried to insert yourself personally into these matters?” Nachman asked. “I was trying to teach a lesson to some managers who were involved with it,” Greenberg said. “This was a non-event at AIG. There are other things that are far more important than this.” “You regard other things are more important than a fraud charge against you?” Nachman asked. “That’s why I’m here to defend against it,” Greenberg said. Greenberg was dressed in a dark-blue suit, a white dress shirt and a light-blue tie. His exchanges with Nachman were sometimes congenial, sometimes contentious. Home Depot co-founder Kenneth Langone, a friend of Greenberg’s who has called for the state to drop the case, attended the beginning of Greenberg’s testimony. The current attorney general, Eric Schneiderman, is seeking to bar Greenberg and Smith from serving as officers or directors of public companies and force them to give up more than $52 million in bonuses. Schneiderman dropped his demand for $6 billion in damages in the case after Greenberg and other executives paid $115 million in 2009 to settle suits filed by AIG shareholders. The trial, which is being heard without a jury, is likely to last through January. Greenberg had asked the US Supreme Court to review a June decision by New York’s top court allowing the trial to proceed, arguing the state claims are pre-empted by federal law.

September 28. A luxury home in exclusive Tucker’s Town with a list price of more than $13.9 million owned by the widow of a late billionaire oil and gas tycoon is set to be sold. Winsor House, set on a cliff-side estate, is owned by Katie McClendon, an heiress of the Whirlpool appliances family and the wife of former Chesapeake Energy Corporation chief Aubrey McClendon, who was killed in a car crash earlier this year, Sinclair Realty, which is selling the home, confirmed yesterday that the property was under contract. But — despite its huge price tag — the house will need major renovations or demolished and replaced with a new-build house. Ms Sinclair said: “While good news and a vote of confidence for Bermuda, Winsor House is actually just one of several non-Bermudian sales in 2016 pending completion which demonstrate the island’s attractiveness to the discerning international homebuyer.” She added: “Subject to planning and environment approvals, a purchaser could work with the existing footprint, but the condition of the existing structures are such that either a total renovation or a tear down, redesign or rebuild would be required.” The McClendons bought the six-bedroom home, set in 1.26 acres of grounds for $11 million five years ago. Sinclair Realty said on its website: “As waterfront building lots in the coveted Tucker’s Town peninsula simply do not exist — and Bermuda Government policy restricts non-Bermudian purchasers from acquiring vacant land — Winsor House represents an extremely rare opportunity to own a world-class beachfront home site. This is literally one of the very best beachfront settings in Bermuda.” The main house has an annual rental value of $216,000, while the apartment’s ARV is $33,600. The grounds also contain a two-level guest cottage and two-level garage. Mr McClendon, 56, founder of Chesapeake Energy Corporation, died when his SUV hit a bridge embankment in Oklahoma City in March. The crash came a day after he was charged with rigging bids for oil and natural gas leases in Oklahoma. It was feared at first that the death was suicide — but a medical examiner later ruled that the death was accidental. Mr McLendon founded Chesapeake Energy in 1989 and at one point the firm was valued at $35 billion, with Mr McClendon’s personal wealth estimated at $1 billion. In addition to buying several Bermuda properties, Mr McLendon held a stake in basketball team Oklahoma City Thunder. But he left Chesapeake Energy in 2013 amid a governance scandal which led to a shareholder revolt and cost him his annual bonus and chairmanship in 2012. He was charged in March by a federal grand jury in Oklahoma in connection with an alleged scheme involving two “large oil and gas companies” to not bid against each other for leases in the northwest of the state. The scheme was said to have operated between 2007 and 2012. Mr McClendon denied the charges and said they were “wrong and unprecedented.” He died in the car crash the next day. If convicted, he would have faced up to ten years in jail and a $1 million fine.

September 27. The Bermuda mansion owned by Hollywood superstars Michael Douglas and Catherine Zeta-Jones is up for sale with a price tag of more than $10.6 million. Mr Douglas is the son of Diana Dill, a Bermudian who became an actor and model in the US and who died last year and American movie legend Kirk Douglas. He is also co-owner of the now-closed Ariel Sands cottage colony in Devonshire, which is scheduled for redevelopment. The historic Warwick mansion boasts eight bedrooms, eight bathrooms, while the grounds of more than three acres contain a gated pool, a tennis court with covered viewing pavilion and an orchard. Lyndy Thatcher, listed as the Rego Sotheby’s International Realty agent for the sale, confirmed the property was listed this month, but declined further comment. Mr Douglas and Ms Zeta-Jones bought the house, then a five-bedroom home, 15 years ago for a price understood to be around $2.5 million. The listing on Rego SIR’s website said: “This spectacular celebrity-owned, gated private estate, with stunning harbour views is a park-like oasis. The centerpiece of the property is a large elegant, yet informal, 1827 ivy-covered home. The beautifully restored main house has a large, spacious living room with fireplace, dining room, gourmet kitchen and children’s suite containing two bedrooms, two bathrooms, music room and den. The upper level of the house boasts a huge master suite with views over Hamilton Harbour, plus a second en suite bedroom, office and large media room. Outside, there are two 50ft cedar verandas, also offering harbour views. The basement area has a gym, including shower, locker room, bath and sauna, as well as a storage area and commercial-size laundry room. The grounds of the estate also contain a two-bedroom guest cottage, a 100-year-old apartment and a two-bedroom caretaker’s cottage.

September 27. A formal objection has been made by the Bermuda Government to the investigation of the airport redevelopment project by the Commission of Inquiry. The commission — which will hold a public hearing at 10am tomorrow — said in a brief statement this afternoon that the Government had “now followed proper procedure” and sent written objections, days after acting Attorney-General, Senator Michael Fahy, held a press conference declaring that the LF Wade International Airport deal was outside the scope of the inquiry. The commission’s statement said: “Subsequent to the Government press conference and statement last Friday, Government has now followed proper procedure which the commission established for those who wish to make objection to any matter which the commission proposes to examine as part of its inquiry. Written objections to the inclusion of the airport were received yesterday from the Attorney General’s Chambers on behalf of the Government. In accordance with our published rules, the commission must deliberate on those objections and proposes to make a decision shortly. Because the issue has been raised publicly, the commission also wishes to state publicly that no undertaking was ever given to the Government that we would not inquire into the airport project.” The independent Commission of Inquiry was formed by Michael Dunkley, the Premier, in February this year with a remit to inquire into issues raised by a damning report from the Auditor-General on how civil servants mismanaged public funds during the financial years 2009 to 2012. Four commissioners — Sir Anthony Evans, Fiona Luck, John Barritt and Kumi Bradshaw — were appointed and they announced in June that they would look beyond those years, probing into government contracts awarded both before and after the period in question. Commission chairman Sir Anthony told the first public hearing in June that the Government’s current airport redevelopment contract would be investigated, along with contentious projects of the past. But Mr Fahy told Friday’s press conference the airport project was not within the commission’s terms of reference and civil servants who received requests from the commission for information relating to the airport “need not reply. Government has been consistent in its representations to the commission that the LF Wade project is not within their terms of reference or scope. The commission has persisted in requesting documents and has asked civil servants to provide information about the airport project. Civil servants need not reply to requests for information that is not relevant to the terms of reference.” The Minister said the Government asked the commission to hold off on requesting documents until the commercial close of the $250 million project with the Canadian Commercial Corporation. But the close was delayed so the commission, said Mr Fahy, went ahead with its requests to civil servants. Tomorrow’s hearing is at St Theresa’s Church Hall, Laffan Street, Hamilton.