Click on graphic above to navigate the 165+ web files on this website, a regularly updated Gazetteer, an in-depth description of our island's internally self-governing British Overseas Territory 900 miles north of the Caribbean, 600 miles east of North Carolina, USA. With accommodation options, airlines, airport, actors, actresses, aviation, banks, beaches, Bermuda Dollar, Bermuda Government, Bermuda-incorporated businesses and companies including insurers and reinsurers, Bermudians, books and publications, bridges and causeway, charities, churches, citizenship by Status, City of Hamilton, commerce, communities, credit cards, cruise ships, cuisine, currency, disability accessibility, Devonshire Parish, districts, Dockyard, economy, education, employers, employment, environment, executorships, fauna, ferries, flora, former military bases, forts, gardens, geography, getting around, golf, guest houses, highways, history, historic properties, Hamilton, House of Assembly, housing, hotels, immigration, import duties, internet access, islands, laws, legal system and legislators, main roads, marriages, media, members of parliament, money, motor vehicles, municipalities, music and musicians, newcomers, newspaper, media, organizations, parks, parishes, Paget, Pembroke, performing artists, residents, pensions, political parties, postage stamps, public holidays, public transportation, railway trail, real estate, registries of aircraft and ships, religions, Royal Naval Dockyard, Sandys, senior citizens, Smith's, Somerset Village, Southampton, St. David's Island, St George's, Spanish Point, Spittal Pond, sports, taxes, telecommunications, time zone, traditions, tourism, Town of St. George, Tucker's Town, utilities, water sports, Warwick, weather, wildlife, work permits.

By Keith Archibald Forbes (see About Us)

|

See end of this file for all of our many History files |

July 31. Insurance and reinsurance firm Lancashire has rejected the idea of a merger with another firm as a way to boost business. Company CEO Alex Maloney said: “I don’t really buy the bigger is better thing. I see no evidence of any of the companies that have got together to be super-companies with a bigger market share on the back of it.” Mr Maloney was speaking in a conference call after the firm posted a 10 per cent drop in first-half profits, pointing to “pricing pressure” in the Lloyd’s of London market. Lancashire was touted as a takeover prospect by analysts earlier this year after Catlin agreed to a takeover by XL. On Wednesday, Lancashire posted after-tax profits of $38.9 million for the second quarter of the year — down nearly $6 million on the $44.8 million recorded for the same period last year. Gross premiums written for the second quarter fell $139.1 million, from $318.4 million to $179.3 million, in the same timeframe. Diluted earnings per share for the three months to June were 19 cents, compared to 23 cents in the same three months of 2014. Lancashire group chief underwriting officer Paul Gregory said: “Our response to the tough conditions has been to maintain underwriting discipline, focusing on bottom line rather than top. This may not be particularly fashionable at the moment, but we remain convinced that our strategy remains correct.” Mr Maloney added: “The whole insurance community will sit and moan about the current market, and it is the worst it’s been in 10 years, but we’re still confident that we can work our way through it. We’re much better the way we are. It is not all one-way traffic but there’s no hiding the fact that this is a difficult market. We have to work hard and, if necessary, decline inadequately priced business.” Lancashire gained access to the world’s oldest insurance market in 2013 with its takeover of Cathedral Capital, which provides coverage ranging from terrorism to aviation risks. The firm said the acquisition “slightly offset” a decline in premiums across other lines of business.

July 31. Somerset retained the Cup Match trophy in a historic victory for the West End — but for many the match is secondary to the experience. Thousands of residents and visitors turned out to enjoy the event, which closed with ecstatic supporters cheering for Somerset Cricket Club. After an ominously rainy week, blue skies welcomed spectators to the two-day extravaganza of cricket, Crown and Anchor and camaraderie. The celebration of emancipation and the Island’s founding was filled with music, food, plenty of alcohol, laughter and smiling faces as cricket fans, and those new to the sport, sat back, relaxed and soaked up the carnival atmosphere. “Cup Match is about family, friends and freedom. It’s about Bermuda coming together,” said Karen Young, of Paget, who was rooting for St George’s. “I love the carnival atmosphere.” Crowds began flocking to the event early on Thursday morning, with the stands gradually filling up over the course of the day. It proved to be a scorcher, with temperatures hitting the mid to high 80s. For St George’s Cricket Club president Neil Paynter, the good weather was a blessing after all the rain the Island had for days preceding the match. “We’ve been working feverishly through the early hours of the morning to make sure the game gets going,” he said on Thursday. Even though tarpaulins were still being fastened down early on Thursday, the venue was prepped and ready to go by the time the first ball was bowled. Mr Paynter thanked all of the grounds crew on and off the field for their hard work. A few spectators expressed surprise that the venue was prepared in time, considering the torrential downpours. Former United Bermuda Party leader Kim Swan, who was having “a great Cup Match”, said anyone who was at St George’s Cricket Club on the eve of the big game would not have thought the event could take place. “We’re really lucky that the gods of Cup Match have decided to bring out the weather for us,” said Mike Cain, CEO of Aspen Bermuda, one of the event’s sponsors. “We hope everyone is going to have a fantastic day and that St George’s are going to pull something fantastic out of the bag.” Free hats and sunscreen were available courtesy of the Bermuda Cancer and Health Centre’s SunSmart programme. “Many Bermudians don’t realize that we have a higher skin cancer rate than the US,” said Azuree Williams, the SunSmart coordinator, who added that sponsorship by the St Baldrick’s Foundation meant they could give out the free items. Ashley’s Lemonade proved to be a hit with spectators looking to cool down, with Cup Match-themed drinks on offer as well as a new frozen version of the young entrepreneur’s famous lemonade. “It’s awesome — I’ve had a lot of fun. This is the fourth year of Cup Match that we’ve done,” said Ashley Stephens, who was kept busy by a stream of patrons. She said the heat was good for business because she sold more lemonade, which was available in mango, strawberry, very berry, blue pineapple, limeade and traditional flavors. Gina Thompson has been a familiar face at Cup Match “come rain or shine” for 15 years and her stall, Sniggle’s Face & Body Painting, offered creative touches to those who wanted to take their Cup Match-themed outfits a step further. Glitter, henna and airbrushing tattoos, face painting and red and blue hair dye were popular among the younger patrons who flocked to the stall. Malcolm Simons, of Paget, was keeping cool by standing in the shade. “It’s gorgeous — it’s just building up,” the ardent Somerset fan said. Mr Simons said his grandfather, who was a St George’s selector, would take him and his brother to the game back when Somerset was the winning team. That settled it for Mr Simons, who added: “I was always leaning towards Somerset.” Grace Smith, who was born and raised in St George’s, was showing her friend Jackie Allen the ropes. “It’s very colorful — I was trying to study the game,” said Ms Allen, from New York. The duo, dressed head to toe in blue and blue, were eager to try their hand at a game of crown and anchor. Cup Match would not be Cup Match without the popular dice game and the Crown and Anchor tent was steadily filling up before noon. “This is what we do at Cup Match. We gamble some of that disposable income. It’s all good fun,” said Funtyme Entertainment’s Craig Tyrrell, one of the concession holders along with Cavon Steede. By lunchtime the tent was heaving with people eager to try their luck at one of the twelve tables. “I won $50 on the Crown and Anchor,” said a delighted Kathy Rodrigues, who was visiting the Island with her husband, Perry, and their grandchildren Steven, 15, and Faith, 10. Resplendent in St George’s colours, the first-time visitors felt it only right to pick the East End team because they were staying in St George’s. The event was also a first for Ty Foster, who was visiting with his father Lee Madeiros Foster, a Bermudian who has been living in the United States for about 40 years. “I love it — It’s beautiful,” Ty said, adding that everyone had been very welcoming and “even the rivalry is friendly”. Mr Foster said that he tried to return to Bermuda at this time of year but it was the first time his son had came along. A newcomer to the Island, Elvira Llabres, was enjoying her first Cup Match after recently moving to Somerset. Proudly supporting the West End team, the Spanish national said she was still trying to figure out the rules of the game, but was having fun. John Faiella, of Southampton, was enjoying the game with his sister, Sue McCarty, and her family. Ms McCarty, who was born in Somerset, was visiting from Berwyn, Pennsylvania. “We come to Cup Match pretty often. I love it — I love the whole carnival atmosphere,” she said. Mr Faiella, a firm Somerset supporter, added: “We always come out — often we have family down. It’s a fantastic event when it gets going. Now you almost get as many tourists down here as locals.” There were plenty of food stalls for those wishing to grab a bite to eat. At St David’s Seafood stall, a popular part of Cup Match for more than half a century, business was booming. “One thing we can’t get enough of and that sells all the time is the shark hash — that’s our speciality,” co-owner Jonathan Lowe said. For those wishing to indulge their sweet tooth, Allison Smith was running her confections stall for the second time at Cup Match. “It started out great because the sun is out — everything after that is a plus,” she said. “I think everyone is going to enjoy themselves.” Spirits were high among those working at the game. Cup Match means Bermuda spirit, Bermuda love, everything Bermuda,” said Neseyah Jones, of the Island Restaurant Group (IRG). “It’s my first time working Cup Match but I’m really enjoying it. It seems like everybody is having a good time. There are no grumpy faces — everyone is smiling,” added Ladezz Cann, who was also catering the event with IRG.

July 31. Wellington Oval, St. George's (second day of two): Somerset beat St George’s by eight wickets. Jekon Edness got his wish, a first Somerset victory at Wellington Oval in 34 years as he stepped down from the captaincy with a third victory in five years at the helm. On the same ground that he started his reign with a two-wicket defeat in 2011, Edness and his team were back with a vengeance, pressing home their advantage after starting the second day with a 41-run first innings lead. It was fitting that Edness was at the crease when victory was achieved at 4.14pm, flicking a delivery from Onias Bascome down to square leg for the winning boundary as hundreds of fans stormed the field. Afterwards Joe Bailey, the last Somerset winning captain in St George’s in 1981, was recognized during the cup presentation. Terryn Fray, just as he was a year ago, was there to guide the team to a second straight eight-wicket victory, scoring 61 not out off 53 balls as he hit six fours and a six. Edness scored a run-a-ball 19 not out with four boundaries, the pair coming together at 49 for two after Tre Manders was caught behind off Stefan Kelly in his second over. “I got a duck in the first innings, like I did last year, but no two days are ever the same, so I went out there today and tried to be as positive as I could,” Fray said. “I just went out there and played my shots. I played some good shots and hit a six. I normally do not hit sixes, but that’s when I knew I was in the zone and playing within myself.” Opener Chris Douglas was controversially caught at short leg by Macai Simmons from a bat-pad chance. Simmons threw down the stumps in one motion as he tried to run out Douglas, only for umpire Kent Gibbons to give the batsman out caught after St George’s initially appealed for an lbw. The two wickets were the only successes for St George’s as Somerset settled down and quickly polished off the runs in 16.2 overs. It was anybody’s game when the day started, with St George’s hoping for a good start to erase the deficit inside the first hour and then build a decent lead. Neither happened, as Somerset were relentless after getting the breakthrough with the last ball of the first over of the day when Jason Anderson was caught at first slip by Janeiro Tucker, his 30th catch in Cup Match. Treadwell Gibbons was trapped lbw by Janeiro Tucker for the second time in the match after putting on 30 for the second wicket with Christian Burgess. Gibbons hit two sixes and a four in his knock of 20 from 24 balls. The departure of both on 31 and 39 left the home team still in arrears and by the time St George’s erased the deficit they were already three wickets down. That soon became four and five as Derrick Brangman had a two-wicket maiden in his first over to break the back of the St George’s innings, leaving them 52 for six with Fiqre Crockwell failing again and Damali Bell lasting just three balls. OJ Pitcher, the St George’s captain, was the last hope and he lasted 46 minutes for his thirteen before a flick off his pads led to his demise at 62 for six, when Derrick Brangman took a brilliant low catch at square leg. Onias Bascome and Macai Simmons took on the responsibility with a patient stand of 38 before aggressive strokes led to their dismissals. That was also the case with George O’Brien as Simmons, the colt, went for a big drive against Jordan DeSilva and edged to Tucker. O’Brien and Bascome departed after lofting straight drives to long off. Simmons scored 30 from 36 balls with six fours to lead the batting, while Bascome scored 28 from 81 balls before he was ninth out. Malachi Jones claimed three for 21, while Brangman, a strong candidate for man-of-the-match after a good all-round performance, took three for 26. He also held two catches in the second innings, with the low-diving effort off Burgess at long off a strong candidate for the Safe Hands Award. It was Brangman’s batting on day one that gave Somerset the edge after the first innings as he shared in a last-wicket stand of 34 with Greg Maybury that proved crucial. St George’s did well to battle back into the match after posting just 113 in 50.1 overs, but the match got away from them slightly at the end. After having Somerset 110 for eight, St George’s watched as the last pair frustrated them for the final half-hour of the day after coming together with Somerset leading by just seven runs. Neither looked a slouch with the bat either, as Brangman smashed 35 not out off 27 balls with four fours and two sixes. Earlier Tre Manders scored 39 from 72 balls with five boundaries, while Stephen Outerbridge added 23 at No 4 as the pair put on 41 for the third wicket after Kyle Hodsoll bowled openers Douglas and Fray to reduce them to 15 for two. Hodsoll led the St George’s bowling with four for 20, later bowling Edness before reserve Nzari Paynter — president Neil Paynter’s 15-year-old son — took a smart catch at extra cover to dismiss Jones. O’Brien supported with two for 58 and Stefan Kelly two for 54. Damali Bell picked up his lone wicket when he bowled Maybury to end the innings just before the scheduled close of play. St George’s were also in early trouble in their innings, with Fiqre Crockwell dismissed from the first ball he faced on the last delivery of the opening over from Jones. Burgess departed nine runs later to first-change Jordan DeSilva. Things picked up after that with opener Gibbons starting to score more freely on his way to 32 before he was fourth out on 65. He hit four fours and a six before being trapped lbw by Tucker. Gibbons did not approve of the decision but put the bat on his shoulder and walked back to the pavilion. Pitcher scored 20 in the middle order and Simmons 16 to help St George’s reach the 100 mark as four Somerset bowlers — Tucker, DeSilva, Jones and Brangman — all took two wickets as St George’s struggled to build partnerships.

July 30. Thousands of residents and visitors alike have turned out to celebrate this year’s Cup Match. After an ominously rainy week, blue skies welcomed spectators to the start of two-day extravaganza of cricket, crown and anchor and camaraderie. The celebration of emancipation and the Island’s founding was filled with music, food, laughter and smiling faces as cricket fans, and those new to the sport, sat back, relaxed and soaked up the carnival atmosphere. “Cup Match is about family, friends and freedom. It’s about Bermuda coming together,” said Karen Young, of Paget, who was rooting for St George’s. “I love the carnival atmosphere.” Crowds began flocking to the event early this morning, with the stands gradually filling up over the course of the day, which proved to be a scorcher as temperatures hit the mid to high 80s. For St George’s Cricket Club president Neil Paynter the good weather was a blessing after all the rain the Island had seen over the past few days. “We’ve been working feverishly through the early hours of the morning to make sure the game gets going,” Mr Paynter said. Even though tarpaulins were still being fastened down early this morning, the venue was prepped and ready to go by the time the first ball was thrown. A few spectators expressed surprise that the venue was prepared in time, considering the torrential downpours of the last few days. Former United Bermuda Party leader Kim Swan, who was having “a great Cup Match”, said anyone who was at St George’s Cricket Club on the eve of the big game day would not have thought the event could take place in light of all the rain and preparation work that needed to be done. “We’re just really lucky that the gods of Cup Match have decided to bring out the weather for us,” said Mike Cain, the CEO of Aspen Bermuda, one of the event sponsors. Cup Match wouldn’t be Cup Match without the popular dice game and the crown and anchor tent was steadily filling up before the clock struck noon. “This is what we do at Cup Match. We gamble some of that disposable income. It’s all good fun,” said Fun Tyme Entertainment’s Craig Tyrrell, one of the concession holders along with Cavon Steede. “Cup Match means Bermuda spirit, Bermuda love, everything Bermuda,” said Neseyah Jones, of the Island Restaurant Group (IRG). ”It’s my first time working Cup Match but I’m really enjoying it. It seems like everybody is having a good time. There are no grumpy faces — everyone is smiling,” added Ladezz Cann, who was also catering the event with IRG. The Royal Gazette will continue covering the sports side of the event throughout the holiday. For the full report, see Saturday’s edition.

July 29. Health bosses are exploring ways to tackle crippling healthcare bills as a new study shows Bermuda costs twice as much as other islands. The Island’s healthcare figure of more than $10,000 per capita per year dwarfs that of all other 14 islands, including nine countries in the Caribbean, in new research by KPMG. The survey, “Key Issues In Healthcare, An Island Perspective”, reveals Gibraltar comes second with about $5,000 per capita, with every other Island about $4,000 or less. Jennifer Attride-Stirling, the new permanent secretary for the Ministry of Health, pointed to a large amount of services being used on the Island — sometimes, she said, without any health benefit. High levels of poorly controlled diseases like diabetes and the ageing population were further reasons for Bermuda’s soaring costs, according to Dr Attride-Stirling. Bermuda Health Council acknowledged Bermuda has a long way to go before patients get value for money, and said it is pursuing initiatives to bring down costs. The survey from KPMG was based on healthcare costs per capita rather than the international standard of using purchasing power parity which eliminates the difference in price levels when comparing the same goods. According to the most recent figures from the World Bank, it requires $1.60 USD to purchase medical goods and services, including hospitalization, operations and prescription drugs in Bermuda compared to the $1 USD that would be required to purchase the same goods in the US. As well as Bermuda and Gibraltar, it gives estimated costs of about $4,000 for Isle of Man, Guernsey and Jersey; about $2,000 for the Bahamas, British Virgin Islands, Cayman Islands, Malta, Turks and Caicos; and lower still for Barbados, Jamaica, Sint Maarten, Suriname and Trinidad and Tobago. Bermuda and Gibraltar do have the highest hospital bed capacity at seven per 1,000 people with Malta trailing in third place with 4.45 beds. And with a life expectancy of about 81, Bermuda is among the six countries higher than 80. Tawanna Wedderburn, acting chief executive officer for the Bermuda Health Council, said that Bermuda’s healthcare system is complex and that the Island has a long way to go to achieving value for money in relation to life expectancy. “The Health Council is analyzing data to see how the health system can achieve greater efficiencies in areas such as overseas care which represents $100 million or 14 per cent of total health expenditure,” she said. “The Health Council is pursuing a number of initiatives in collaboration with stakeholders to address key drivers of costs. In addition, we continue to examine ways that yield long-term cost savings and can improve the health of the population by reviewing the Standard Health Benefit (SHB); the basic package of care that every employed person and their non-employed spouse is required to have. For all SHB services, there are no co-payments for patients. A very good example is the Home Medical Services Benefit which saved the health system an estimated $100,000 in the first six months. This benefit allows patients to receive specific medical procedures in their home as part of their insurance policy. It is natural to want to blame others but, in a system where total health expenditure is $705 million, we all have a role to play in improving our health spending. We can begin by choosing the types of services that are truly proven to enhance our health and longevity.” Dr Attride-Stirling said several BHC reports had highlighted health cost trends. She said: “From these trends we can see the main drivers are the amount of services being used, at times with no health benefit; high levels of chronic non-communicable diseases (NCDs) that are poorly controlled, such as diabetes; and the fact that our population is getting older which naturally comes with more need for healthcare. In addition there are efficiencies to be gained with respect to healthcare delivery and financing in our health system. There are many initiatives under way to reduce costs and, in fact, we are seeing some green shoots already. We know diagnostic test ordering has gone down, the Standard Health Benefit includes more coverages to drive care to more appropriate, cost-effective settings, for example Home Medical Services, and various initiatives to better manage NCDs will also improve care quality and reduce costs.” Steve Woodward, managing director at KPMG in Bermuda, said: “The survey findings show that island healthcare systems are experiencing the combined challenge of rising costs, increasing demand and greater patient expectations. Island governments have the added challenge of finding the optimal balance between providing care locally or abroad.” The BHC provides advice to help mitigate high costs while avoiding unnecessary testing or inappropriate use of emergency services. Information is available online at bhec.bm including the Guide to Bermuda’s Health Costs which details how to use services correctly, understand prices and reduce the need for care. There is also a healthcare directory which allows patients to choose among the options available for care.

July 29. The Department of Parks has announced a temporary traffic scheme for Horseshoe Bay for tomorrow, and that the beach will be closed to the public tomorrow evening as part of a cleanup effort. A spokeswoman for the Park Service said in a statement: “On Thursday at 7pm a clean up of Horseshoe Bay is scheduled to commence in preparation for the following day. We ask all patrons to kindly exit the park at this time so that the work may be carried out.” The statement also said that between 6pm today and 9pm tomorrow, parking and the traffic flow around Horseshoe Bay car park will be strictly regulated by the Bermuda Police Service and the Department of Parks. “There will be absolutely no parking allowed on the sidewalk leading down the hill,” she said. “Vehicles found parking on the sidewalk will be ticketed by police. Parking of motorcycles will be permitted at Horseshoe Bay Car Park. Once full, no bikes will be allowed to park at the bottom of the hill. The Department of Parks will be responsible for ensuring that barriers and a member of our department is in position at the entrance of Horseshoe Bay Beach Road.” Between 6.30am and 8.30pm tomorrow, Horseshoe Bay Beach Road will operate as a one-way traffic system with vehicles exiting through the Southampton Princess gate. Four wheel vehicles will be allowed down the hill for drop offs and pickups only The spokeswoman added: “The one way system will be used to facilitate taxis and mini buses to drop off and collect passengers from the beach. Once taxi and minibus spots are full no other vehicles will be given access except to drop off patrons.”

July 29. Jekon Edness has extra incentive to go for a victory at Wellington Oval over the next two days, because this will be his last year as Somerset captain. Edness confirmed this week that he will be stepping down after five years at the helm and would dearly love to go out with a win, something Somerset have not achieved in the East End since Joe Bailey’s 1981 side scored a comfortable victory. Edness started his captaincy there in 2011 with a loss, before winning in Somerset in 2012 and 2014 after the intervening match ended in a draw. “It’s my fifth and final, I have personal and professional commitments and I think the captain of Somerset needs to be at every [training] session and committed to the cause,” said Edness, now married and expecting his second child later this year. “I’m not sure I can do that next year so I don’t want to be cheating the club, plus five years is a long time and I think it is the right time for a new captain to come in and take on a settled team. This will be the ideal time to shift someone younger in.” Edness, still only 31, intends to continue playing in Cup Match, but admits there are other things to look forward to. His decision comes less than a year after opposing captain Oronde Bascome stood down. Edness informed Alfred Maybury, the Somerset president, of his decision last week before making the announcement to the membership on team selection night. “It is something I’ve been thinking about since last year, trying to figure the right time to let someone else take over,” he said. “I felt the best time was this year so if a new captain comes in then he would come in, in Somerset where you have a lot more control. Five years is long enough for me, I have professional goals such as another certification professionally and with a second child coming in December.” Edness got his start in senior cricket playing as a 14-year-old with his father, Anthony Manders, at Western Stars. He was happy earlier this season to give youngster Jahnoi Bean a chance to keep wicket for the Somerset senior team. “In this situation where I had control of the team, and him [Bean] being the under-19 national squad wicketkeeper, and with a tournament coming up, he needed to get as much match practice as possible in his first year playing in the Premier Division,” Edness said. “That’s how my daddy brought me along, letting me ‘keep’ in certain games. If the game was a formality he would say ‘come on, put the gloves on’ and I’d go and keep wicket for the last four or five overs as a 14- or 15-year-old.” Edness replaced Jacobi Robinson as Somerset captain, following his uncle Andre Manders as captain of the West End side. “The captaincy was never part of my plans. It fell in my lap pretty much, and at the time I needed the challenge and motivation to take me forward,” Edness said. “But, right now, I think I want a little less responsibility on the cricket field, to play and enjoy it right now.” He admits that there is a lot of extra stress that comes with being a Cup Match captain. “Everyone’s got their opinion and has their say, who you should pick, who you shouldn’t pick and what you should do,” Edness said. “You deal with it. This year has been a little more hectic than any of my previous four years as far as all the talking is concerned, so it will make my last year interesting. Whoever the next captain is comes into a settled environment. Jeff Richardson [the Somerset coach] deserves a ton of credit. It wasn’t an easy situation when I came into the captaincy. I stepped into a lot of turmoil and I wouldn’t want that for whoever comes in after me.” Somerset have been transformed into a strong unit during Edness’ time in charge, and will again be tough to beat. “We are geared up pretty good. Of course we can’t control the weather so we’re not too concerned about that at all,” Edness said. “It wasn’t ideal that we didn’t have a trial match on Saturday either, but our team is pretty settled anyway. It’s been 34 years and the fans are expecting a victory. We’re going to do our best to put St George’s under pressure and get that long-awaited victory in St George’s. We are confident without being cocky or complacent, but to focus on whatever team they put out and try to beat that team. They haven’t picked a spinner so all their attack is medium pace. Obviously we’ll have to see how the wicket plays and watch their bowlers. Bermuda wickets tend to turn no matter how much grass is on the wicket and hopefully when it does start to turn our spinners will come to the fore. If not we have enough in the pace and seam department to cause trouble as well.”

July 29. The sprawling former Lantana cottage colony is up for sale with a $16.9 million price tag. The ten-acre Sandys property with views of the Great Sound, the venue for the America’s Cup in 2017, has been closed for decades. It was bought by US business tycoon Larry Doyle, who also owns the Newstead hotel and Belmont golf course, in 2008. Lantana, the Island’s first cottage colony, opened in 1958. In its prime, it boasted extensive gardens, a croquet lawn, tennis courts and includes a private beach. It closed in 1998 and has become derelict in recent years. It is thought Mr Doyle paid between $12 million and $15 million for Lantana seven years ago. Mr Doyle could not be contacted for comment yesterday. The Lantana site is listed by real estate firm Rego Sotheby’s International Realty, which said it offered “endless possibilities to be transformed into a new luxury paradise resort in one of Bermuda’s most coveted locations”. The listing added: “Lantana is ideal for investment and future development. The property is zoned as tourism with a small limited area zoned as agricultural. Previous planning approvals in principle have included 28 hotel condominiums, 13 hotel residences, beach club, two swimming pools and clubhouse. In addition, Lantana offers another option — planning approval had been given for a draft subdivision of 13 lots with the main lot being retained as a hotel component and the remaining 12 lots as residential. This development opportunity offers the discerning investor a rare opportunity to restore Lantana and add to its natural charm.” New York-based Mr Doyle, managing director of hedge fund and mutual fund managers Horizon Kinetics also controls real estate investment firm Katierich Asset Management. He bought the Lantana site while on vacation in Bermuda. Mr Doyle said last year that plans to redevelop the Somerset Bridge site were on hold while he concentrated on Newstead, which was in receivership when he bought it last year. But he added he hoped to eventually develop Lantana, which would share ferry and limousine services with its sister properties.

July 29. A man caught with false passports now faces additional charges of money laundering and illegally obtaining a Bermuda passport. Prosecutors said that while the defendant had a Bermuda passport in the name of Alfred Alva Thompson, they are unsure of his actual identity, listing alternate names William Gates and Watson Ogon on the charge sheet. Earlier this month, the defendant denied charges having a false British Overseas Territories Citizen passport, tendering a false application to obtain a Bermuda passport and using an irregular Bermuda passport. Returning to court this morning, he was further charged with dishonestly obtaining a Bermuda passport between August 2, 2010, and June 14, 2013, and possessing $63,700, which represented at whole or in part the proceeds of illegal activity, on July 16 this year. He has denied all of the charges. During today’s hearing, prosecutors said he is believed to be a Ugandan national and may have used as many as 23 different aliases. Despite a bail application by defence lawyer Marc Daniels, Magistrate Khamisi Tokunbo remanded the defendant into custody. The matter is set to return to court on August 12.

July 29. Usually when anger strikes you see red but when Premier Michael Dunkley entered his office yesterday morning to find he had been duped, all he could see was blue and blue. Mischievous colleagues from the Cabinet Office, he suspects, had decked out this devout Somerset fan’s entire office with the St George’s colours, even taking the effort to hide his little red and blue Gombey doll behind a curtain. A map of Bermuda on the wall painted in red and blue was draped in a St George’s flag while metallic blue balloons and streamers hung from every crevice. It was an east ender’s Cup Match dream. Mr Dunkley invited The Royal Gazette to his office to see, first hand, the damage that had been done. He told us: “In my time here as Premier, they know where my colours lie. It was very clear to me that there are a lot of St George’s fans in the Cabinet office so I am not too surprised. What is interesting about it is I can’t find any leads at this time about who might have done it because everybody has denied any involvement and some of the chief culprits have plausible excuses. I called in (Police) Special Branch but they tell me they are too busy with Cup Match. As I have told the Cabinet Secretary [Derrick Binns] several times, revenge is a dish best served cold.” Asked whether the overwhelming sight of blue and blue on his own territory had affected his Cup Match persuasions at all, the Premier responded: “Cup Match is a time where everyone enjoys the holiday and celebrates and remembers how we got here. There is no question in my mind that someone went to a great degree of effort to do all of this but let there be no question, I will not be changing teams. But I will be in St George’s for the two days and on Saturday when I come into the office to catch up on some work, I will be in comfort with the blue and blue because I will know they gave it their best effort but the cup is still in the west end of the Island.”

July 29. Validus Holdings Ltd took a $48 million hit from claims related to an oil rig explosion that left four people dead, the Bermuda reinsurer revealed last night. The platform, which was owned by Mexican state-run oil company Pemex, burst into flames in April this year. A fleet of fire boats was sent out to extinguish the blaze after more than 300 workers were evacuated. Despite the hefty claims, Validus recorded net income of $64 million for the quarter, 58 per cent down from the April-to-June period last year. And operating earnings were $98.3 million, or $1.13 per share, falling just short of analysts’ consensus forecast of $1.16. Validus chairman and chief executive officer Ed Noonan said: “During a quarter with meaningful loss activity in our core classes of business, Validus delivered a 10.7 per cent annualized operating return on average equity, a strong result in the current market. “Our diversified business model with a focus on short-tail lines continues to provide a strong platform for a thoughtful expansion into new classes of business and markets. The foundation of our success is our world-class staff and an outstanding set of proprietary analytical tools that benefit both our own results and those of our clients. Above all, we remain committed to underwriting profitability and will continue to adjust our portfolio to maximize results in the current market conditions.” Both Bermuda-based reinsurance unit Validus Re and Lloyd’s of London operation Talbot wrote less business. But the group as a whole increased gross premiums written to $727 million, up from $655.7 million in the second quarter of 2014. Validus said the 10.9 per cent increase was primarily due to the contribution from Western World, the US insurer that the group acquired in October last year, as well as an increase in premiums from AlphaCat, its alternative capital management arm. Validus’ second-quarter combined ratio — the proportion of premium dollars spent on claims and expenses — was 80.7 per cent, which benefited from 12.3 points, or $70.7 million, of reserve releases. During the second quarter, the company spent $85.1 million to repurchase nearly two million of its own shares at an average price of $43.23. At the end of June, total shareholders’ equity was $4.2 billion, including $510 million of non-controlling interest. Book value per diluted share was $41.43, compared to $41.27 three months earlier. Before the results were announced, Validus shares fell nearly 1.5 per cent in New York trading yesterday to close on $44.62.

July 29. Stormy weather helped push down second-quarter profits for reinsurance firm RenaissanceRe, the firm reported yesterday. Profits for the period fell $55.6 million year on year from $120.8 million to $73.2 million. Operating income for the firm totaled $99.9 million for the second quarter, compared to $93.6 million for the second quarter of 2014. Operating earnings per share were $2.18, short of the $2.23 consensus forecast of analysts tracked by Yahoo Finance. The firm reported that the catastrophe reinsurance segment generated underwriting income of $65.9 million in the second quarter compared to $82.4 million in the same period of 2014. The report said: “The $16.5 million decrease ... was driven by a $28.9 million increase in current accident net year claims and claim expenses, primarily due to a number of weather events in the US, partially offset by a $10.2 million increase in favorable development on prior accident years net claims and claim expenses.” Gross premiums in the specialty reinsurance sector jumped by more than $108.5 million to $160 million year on year — a 210.4 per cent increase. RenaissanceRe said the increase was driven by “increases across substantially all lines of business, most notably certain casualty and property other lines of business, principally due to the acquisition of Platinum Underwriters Holdings Ltd on March 2, 2015”. The report added: “The company’s specialty reinsurance premiums are prone to significant volatility as this business can be influenced by a relatively small number of relatively large transactions.” Gross premiums written in the Lloyd’s of London segment were $116.6 million in the second quarter, an increase of $44.7 million (62.2 per cent) compared to same period last year. RenaissanceRe chief executive officer Kevin O’Donnell said: “I am pleased to report $99.9 million of operating income, an operating return on equity of 9.1 per cent and 1.9 per cent growth in tangible book value per share plus accumulated dividends for the quarter. Each of our segments executed well during the quarter and we expanded our underwriting capabilities to support our clients, despite the competitive market conditions. Our integration of Platinum has gone well. We are operating as one company with a consistent and united approach to the market. We remain committed to our goal of generating superior returns for our shareholders and third party capital providers over the long term by continuing to be market leaders in matching desirable risk with efficient capital.”

July 29. Global insurance and reinsurance broker Marsh & McLennan Cos (MMC) (which has a number of Bermuda-incorporated companies) is looking for ways to trim its tax bill. In a conference call yesterday, Dan Glaser, the New York-based company’s chief executive officer, said: “The search for tax efficiency for us started several years ago. Clearly, when we look at our competitors, we are at a disadvantage by being a US multinational company vis-à-vis what tax rate we have.” His comments came after MMC announced second-quarter profit of $419 million, down from $431 million a year earlier. MMC is the largest broker in the insurance industry by market capitalization. Its major competitors are Aon and Willis Group, both headquartered in London. Towers Watson, a US-based firm that competes against MMC in consulting services, agreed last month to merge with Willis. Executives plan to have the combined business domiciled in Ireland and have a tax rate in the mid-20 percent range. Aon, the second-largest insurance broker, moved its headquarters in 2012 to London from Chicago. MMC’s effective tax rate has been about 29 percent in recent years. The broker hired Dina Shapiro, a former executive at American Express, as head of tax in March. MMC said its revenue fell 3 per cent in the second quarter as the stronger dollar continued to weigh on results. The firm, which has offices in Bermuda operating under the Marsh and Guy Carpenter names, generates more than half of its revenue outside of the US. In 2014, 34 per cent of its top line came from Europe. Mr Glaser said he was pleased with the performance “given the macro headwinds we are facing.” In the company’s risk and insurance segment, the larger of its two businesses, revenue fell to $1.75 billion from $1.79 billion. The company’s consulting business posted a revenue decrease to $1.49 billion from $1.52 billion. Earnings per share were flat at 77 cents. Revenue fell to $3.23 billion from $3.3 billion the year earlier. Analysts were looking for 79 cents in earnings per share and $3.35 billion in revenue. MMC shares were trading down nearly 1 per cent at $57.49 in lunchtime trading in New York.

July 29. Telecoms firm KeyTech today posted losses of $1.9 million for the year ended in March. The figure was $200,000 up on losses for the previous year. A statement from the firm added: “Net loss for the year from continuing operations was $15.9 million versus $2.1 million in the prior year. A loss of $18.6 million was attributed to the difference between proceeds from the sale and recorded net assets of BTC.” KeyTech CEO Lloyd Fray said: “The last year was one of strategic positioning and growth for the company. KeyTech has positioned itself to offer robust triple play services and corporate data solutions over expansive and reliable network infrastructures as consumers substitute internet-based entertainment for subscription digital cable TV and businesses exponentially increase their bandwidth requirements. Through our subsidiaries, KeyTech is positioned as the leading full-service telecommunications provider for corporate and residential customers in both Bermuda and Cayman.” And he predicted that the full impact of the firm’s repositioning and acquisitions would be seen over this financial year. The firm posted operating revenues of $66.9 million compared to $39.1 million for the previous year. Revenue from voice services declined by $0.5 million as customers swapped from traditional landlines to cellphones and computer-based phone services. Operating expenses went up by $31.6 million — attributed to consolidating Bermuda CableVision and WestStar TV. Salaries and employee benefit costs went up by $6.4 million due to increased staff numbers through acquisition. Loss attributable to shareholders was $13.7 million at year end, compared to a profit of $5.7 million the previous year. Dividends for the first quarter of the financial year amounted to $1.3 million (nine cents per share). The previous year’s figures were $7 million (48 cents a share). The statement added that KeyTech’s basic and fully diluted loss per common share was 88 cents, compared to earnings of 39 cents in 2013-2014.

July 29. A worker died this afternoon in an industrial accident at the Pink Beach property. According to Police spokesman Dwayne Caines, authorities attended an industrial accident at a hotel construction site on South Road in Smiths at 2.18pm. Mr Caines said a 62-year-old man was operating a forklift when it toppled over an embankment, trapping him inside. The area around the accident has been cordoned off by Police as an investigation is carried out. The Forensic Support Unit and officers from the Bermuda Government’s Health and Safety Department are on the scene. Spokesman for the Bermuda Fire and Rescue Service, Acting Lieutenant Jamal Albuoy, said the service responded to the industrial accident with an appliance from Hamilton Station, two appliances from Clearwater Station and ten personnel. “Upon arrival, it was discovered a piece of heavy machinery had lost its footing and gone over an embankment with the operator trapped inside,” he said. “Another excavator machine on-site was used to assist with getting the occupant out of the wreckage. The accident is under investigation at this time by the Health and Safety Officer and the Bermuda Police Service. No other details will be released at this time.” Premier Michael Dunkley said in a statement this afternoon that the accident was a “sad and terrible tragedy. I wish to extend my sincerest and heartfelt condolences to the gentleman’s family, his friends and his co-workers and let them know that they are in our thoughts at this very difficult time."

July 29. RG Editorial. It is to be hoped that Mother Nature has got her rains in early and we can now enjoy two bright and sunny days of Cup Match cricket at Wellington Oval without interruption. So what of the cricket? Little of that has been mentioned in this space this week — and for very good reason — but for about nine hours on each of tomorrow and Friday, 22 men will be charged with entertaining the thousands who flock to the East End of the Island. These men will be representing their clubs, they will be representing their families, they will be representing their communities, they will be representing Bermuda. For some, especially in the St George’s camp, the theme could very well be redemption. Before rain ruined what was likely to be another big win for Somerset in the previous match in the east in 2013, outstanding batting by Janeiro Tucker and Tre Manders for the champions had been overshadowed by the behavior of the home team, in particular that of Treadwell Gibbons Jr. The left-handed early-order bat was unofficially banned by St George’s last year, but he gets another chance to show his club and the wider public, in particular, that he can handle the big stage and that he can carry himself in a manner that is reflective of the spirit in which Cup Match is meant to be played. For Gibbons, no matter his success or failure on the field, this will be his “Redemption Day.” Both he and St George’s have much to lose; the player because he officially begins the first of a two-year Cup Match probation and the club, which risks a public relations disaster should the gamble backfire. However, the man previously dubbed enfant terrible appears to have made steady progress in recent times on the path to public forgiveness, highlighted by him staying clear of the madness that enveloped five Cleveland County team-mates at St David’s County Cricket Club on Saturday before last at the Eastern Counties Cup first round. It is to be hoped that the same backers who have helped to turn him around, in the event his Cup Match is successfully uneventful, may also be driven to seek a reduction to a five-year football ban, the length of which appears disproportionate to the crime. But redemption may not be the catchword for Gibbons alone. So, too, for Christian Burgess, Onias Bascome and Kyle Hodsoll. The first two were dropped last year, but my how did Burgess bounce back: the wicketkeeper-batsman, whose colt year was memorable most for dropping Manders before he had reached double figures, was easily the outstanding Bermuda player last year on a disastrous tour to Malaysia, which resulted in the cricket board vice-president who was standing in as coach at the last minute being summarily booted off the cricket board upon his return. You just couldn’t make it up. Only in Bermuda. Bascome, who stunningly also found himself on that tour despite having shown little to suggest that he was a Bermuda senior player, is best remembered for being off with the fairies in 2013 when he contrived to get run out at the non-striker’s end from ... it might as well have been Penno’s Wharf. “What was he thinking?” was a recurring moan. Both can only improve, which could spell trouble for Somerset. So on to the game. Can we expect to see new champions this year or will Somerset maintain the status quo? Drum roll. While St George’s appear to have been strengthened with six changes from last year, Somerset still hold the upper hand man for man and, with a settled team, have to be considered firm favorites. Last year’s win at Somerset Cricket Club was no fluke, despite George O’Brien’s fantastic eight-wicket haul in the first innings that had red-and-blue hearts fluttering on the Thursday night and for part of Friday morning. But St George’s ultimately suffered for not having anyone to adequately spell a tiring O’Brien — cue the failures of the aforementioned Hodsoll (none for 81 from 20 overs) — with their only reliable option being a left-arm slow bowler who was making his first appearance in Cup Match. They do not even have that alternative now, with Delray Rawlins staying in England to further his chances of joining the professional ranks. The other spinner, Rodney Trott, the long-time vice-captain from Bailey’s Bay, threw his toys out of the pram weeks ago after he was overlooked for the vacated captaincy, thus ending a Cup Match run that dates back to the Noughties. Only in Bermuda. So the challengers will attempt to win back the cup without a recognized spinner — and, to be fair, the “recognised” spinner was hardly recognized two years ago when Tucker and Manders raced to their centuries on virtually a steady diet of medium-paced dross. The same should be the case this time around — the medium-paced element, that is — but on a pitch that is likely to be under prepared owing to the vast amounts of rain that have been dumped on the Island every day since the final trial was washed out on Saturday without a ball bowled. It is every grounds man's dream: preparing a “result wicket” with a ready-made excuse (although there is no suggestion that the venerable Cal Richardson would take the low road. Would he?). In any case, what could make this match closer than it looks on paper is that O’Brien will take the new ball in harness with the returning Stefan Kelly, who has good memories of Cup Match in St George’s, having taken ten wickets in the 2011 match to become most valuable player. The challengers will need him and O’Brien to fire because elsewhere their capacity to take 20 wickets, unless the pitch makes geniuses of even the ordinary, is highly questionable. Hodsoll swings it but we saw enough of him last year to know that a serious improvement is needed, while Damali Bell has it to prove. Somerset hold most of the aces: experience, quality, what qualifies for pace on this Island and both options for spin. They also have Janeiro Tucker, the greatest run-scorer in Cup Match history, who will be reminded of his first-ball duck last year but who will also remind that his record in St George’s is superior to all others. They are so strong that they can survive the extended absences for differing reasons of Kamau Leverock and Dion Stovell, both of whom qualify for “first name on the team sheet” status for St George’s. There are a number of others in the Somerset camp of whom the same can be said, so that shows the scale of the task that befalls the home team. A young team with a young coach. They require two days of good, solid cricket, which may be a stretch in an era when sustained periods of good cricket are thin on the ground, and a helpful dollop of luck.

July 28. RG Opinion. Hearkening back to the jargon of his military days, Colin Powell once referred to optimism as the ultimate “force multiplier” in political life. He was slipping into Pentagon-speak for a capability which dramatically enhances (or multiplies) the probability of successfully achieving a desired objective. Battle-hardened in Vietnam and further steeled by the cynical gamesmanship and rampant political maneuvering he encountered in Washington DC, the former chairman of the US Joint Chiefs of Staff and Secretary of State hardly fits the standard profile of a cock-eyed optimist. After all, he has a better appreciation than most of the frequently amoral power dynamics of realpolitik as it is generally practised in the modern world. Almost unfashionably high-principled in an age of counterfeit convictions and disposable ethics, General Powell walked away from a Cabinet-level position in the last Bush White House rather than continue to lend his moral authority to the quagmire of the Iraq invasion. Perhaps precisely because of his first-hand exposure to the serial contrivances and distortions of a war lobby that promised the world a three-week “cakewalk” in Iraq, his faith in the power of optimism to alter the political culture for the better remains undiminished. This longtime friend of Bermuda — and longer-time friend of Sir John Swan, the former premier — has never fallen prey to the routine thinking which too often reduces the political process to a lackluster choice between the despicable and the merely distasteful. Gen Powell’s point is a simple and incontestable one: the hopefulness and enthusiasm a leader brings to his or her position can be contagious, can in fact spread through an entire country like ripples in the proverbial pond. So, of course, can the cynicism, pessimism and coldly self-serving calculations of leaders who exploit discontent and social divisions to further their own ends rather than those of their people. Tempering idealism with realism, pragmatism and sound judgment, Gen Powell has said, allows for confidence and a renewed sense of the possible to flow from the top down. “Leadership is all about people,” he has said, “and getting the most out of people.” So according to what could be termed the Powell Doctrine of Achievable Political Objectives, successful leadership is often best predicated on conveying a sense of purpose, belonging and direction. This is particularly true at times when the gulf between expectations and straitened realities has opened up to the degree it has in the post-recessionary world. “You have to have a sense of optimism,” said Gen Powell. “Followers need to know where their leaders are taking them and for what purpose. Purpose is the destination of a vision. It energizes that vision, gives it force and drive. It should be positive and powerful. Good leaders set vision, mission, and goals. Great leaders inspire every follower at every level to internalize their purpose.” Gen Powell, who was recently in Bermuda on a private visit, is too modest — and perhaps too much the consummate diplomat — to ever suggest a vision of leadership he freely admits is drawn from personal experiences and observations is the final word on the subject. Nevertheless, his commonsensical leaps from perception to deduction, from the particular to the general, do have much to recommend them, particularly on an Island where optimism was one of the chief casualties of the 2008 economic contraction, along with full employment, a buoyant real estate market and a burgeoning Gross Domestic Product. The ongoing coarsening of Bermuda’s political discourse, the over reliance by both parties on what spin doctors call “negative messaging” to amplify and reinforce existing doubts and fears, is continuing to sap the morale of our people and undermine the confidence of overseas investors. Managing the complex and turbulent events that are shaping our times is no easy task. No one is suggesting there will not ever be legitimate disagreements and differences of opinion on the best way to manage them: as the historian Barbara Tuchman remarked, a country that substitutes placid consensus for healthy debate on every issue is a country ready for the graveyard. However, a country that allows incessant partisan political squabbling, non-stop electioneering and scare mongering to regularly overshadow the common good and the public interest is a country which is also hastening its way to the graveyard. No matter the true extent of its utility as a “force multiplier”, a healthy infusion of optimism — particularly given the potential of the America’s Cup and its associated benefits to revitalize our long-stagnating economy — would be the most welcome of developments on the Bermudian political scene at this juncture.

July 28. The Hamilton Princess and Beach Club has been named the official hotel of the 35th America’s Cup. A statement from the America’s Cup Authority noted the hotel’s recent $100 million renovations. Harvey Schiller, the commercial commissioner for the 2017 event, hailed it as a great partnership. “The world-class accommodation and celebrated restaurants at the Hamilton Princess and Beach Club provide a perfect Bermuda experience for our guests who are coming to enjoy the America’s Cup.” Allan Federer, general manager at the Hamilton Princess and Beach Club, said the iconic hotel looked forward to hosting dignitaries in newly designed rooms. Key events for the Cup will be held at the waterfront premises. The 35th America’s Cup is now underway after the opening races for the Louis Vuitton America’s Cup World Series in Portsmouth. Racing comes to Bermuda in October, with the Louis Vuitton America’s Cup World Series Bermuda, from October 16 to 18.

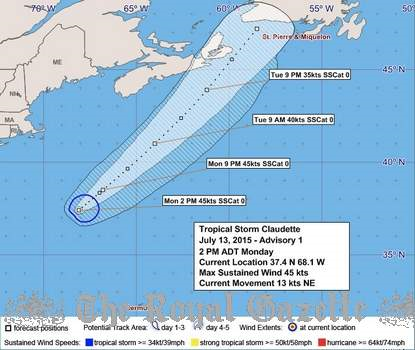

July 28. Unsettled weather is set to give way to sun just in time for the Cup Match holiday, according to the Bermuda Weather Service. While the Island has seen bouts of heavy rain in recent days — including more than 3.6 inches on Saturday alone — meteorologist Rob Howlett said yesterday afternoon that conditions are expected to improve. “The simplest way to explain our recent unsettled weather is due to a stalled frontal boundary,” he said. “Subtle variations in the positioning of this feature produced some of the wetter days as the boundary moved closer to Bermuda. “An area of low pressure is currently developing along this front to our west, which will then move through on Tuesday. This continues to produce showers and potential thunderstorm activity with an increase in winds as well, but then clears to our east overnight. High pressure and fairer weather will then build into the start of Cup Match.” As of yesterday afternoon, a mix of sun and clouds is expected on Thursday with partially cloudy weather on Friday.

July 28. The banners along Mullet Bay Road leading to Slip Road make a bold statement to the St George’s Cup Match team, the residents are desperate for a victory. Messages like “don’t miss those catches” and “we want a victory” greet motorists as they enter St George’s and the players are taking notice, too, hoping to end three years without the cup after Somerset’s bruising victory in 2012. “It’s a young team, but there are two things I’m looking to do here, rebuild and win the cup back,” Ryan Steede, who is in his first year as coach, said. “The captain [OJ Pitcher] is the senior player in the team, as well as George O’Brien, while Jason Anderson is going to be asked to step up as he’s the oldest player in the team,” Steede said. “He has to carry a bulk of the load so it is very important for him to rise to the occasion.” Anderson won’t be burdened with opening the batting and keeping wicket, with Christian Burgess being given the wicket keeping responsibilities while Anderson concentrates on his batting, possibly opening with Treadwell Gibbons, his Cleveland team-mate. Clevie Wade is assisting the team as manager and assistant coach, and brings to the team the experience of winning back the cup in 1983 after Somerset won it in 1979, their first victory in 20 years. “We basically have to get 20 wickets and I feel that the bowlers we have picked can get those 20 wickets,” said Wade as he watched the St George’s Colts team nearly pull off victory in the Colts Cup Match on Sunday. It’s going to take the strike bowlers and whoever else the skipper calls upon to do the job,” Wade said. “Guys have to step up to the plate and show commitment from ball one to the last ball of the game. Guys have to be hungry, passionate and work hard. Somerset are going to come here to play cricket and they won’t lie down. One thing about them is they seem to stick to a plan and that’s what we have to do. We need to put runs on the tins and take wickets and I feel we’ve got the team to do that.” St George’s made an additional three changes to the three forced upon them through unavailability. Oronde Bascome, who stood down as captain, has been dropped along with Shannon Rayner, his Southampton Rangers team-mate, and Lateef Trott. In their absence a strong emphasis has been put on a four-prong seam attack with Damali Bell and Stefan Kelly coming back to link up with George O’Brien and Kyle Hodsoll. “George has the backup this year, but we have to make inroads early and put the pressure right on them from ball one,” Wade said. A deciding factor could be the rain with more in the forecast up to at least Thursday. “Mother nature is going to play a part in this but if we have two full days then we will have some outstanding cricket,” Wade said. “Two good teams have been selected, but for us to win the cup we have to be more hungry and have the will to win.” Wade won the cup against John Tucker’s side in a 1983 match that had some rain. Now St George’s have contend with Tucker’s son Janeiro, who always seems to produce something special at Wellington Oval where he has scored his four centuries, the last in 2013. “Janeiro is the key for them, they feed off Janeiro,” Wade said. “Down here is where he makes his runs but if the chance comes we have to take it. The vibe is here, everybody in the community is feeling it and I’ve talked to a lot of people who feel this could be the year. The [banners] are good motivation, they will tell you what it takes to win, hold your catches and take wickets. I’ve been out of Cup Match for years, but now as a coach and a manager I still get nervous. I’m just asking the youngsters coming in to put their best foot forward and do their best.”

July 28. By Tim Marshall, a senior litigation lawyer and consultant with the law firm of Marshall Diel & Myers Ltd. He represented Bermuda Press in its appeal to the Chief Justice. "The Chief Justice’s decision is a landmark ruling because it has removed 60 years of darkness from our judicial system, which prevented the public from clearly seeing and understanding what was taking place before the courts of Bermuda. In 1955, the Supreme Court (Records) Act was passed into law. The legislation requires the court to keep a record of all proceedings that are commenced, and it sets out in what circumstances a member of the public can obtain copies of court records. It also sets out those circumstances when a member of the public will not be permitted to obtain copies. If a case has been concluded and a judgment delivered that is not the subject of an appeal, the legislation allows any member of the public to apply to the Registrar of the Supreme Court and inspect the court file and, with a few exceptions, obtain copies of whatever is on file. Giving the public access to judicial records recognizes and respects the public’s right to witness, discuss and criticize how our courts administer justice. We can all recall our European history and the atrocities that transpired when justice (if you can call it that) was carried out behind closed doors with no accountability to the public. The “Open Justice” principle is so fundamental to our democracy that it is enshrined in our constitution, the Bermuda Constitution Order of 1968. Section 6(9) of the Constitution says that “all proceedings instituted in any court for the determination of the existence or extent of any civil right or obligation, including the announcement of the decision of the court, shall be held in public.” Access to justice and obtaining copies of documents from the records of completed cases all makes perfect sense. What happens, however, when the case is not completed, when it has either yet to be heard by the court or the hearing is under way? What does the Supreme Court (Records) Act say about that? Well, for 60 years the accepted but untested orthodox view was that no member of the public could inspect the court file or obtain copies of the documents filed by the parties until the completion of a case. Statements of claim, defences, witness statements, affidavit evidence, all of these documents were considered the property of the parties to the litigation, and none of these documents were available to the public. You had to wait until the case was over. This limitation to giving access to the court records, arises from how generations of judges, attorneys and those people familiar with the Supreme Court (Records) Act have been reading 3(2)(a) of the Act, which says: “Nothing in the foregoing provisions of this section shall be construed so as to require or authorize the Registrar, on the application of any person not entitled by any provision of law, and not duly authorized in that behalf, to allow the inspection or examination, or to prepare and furnish copies, of any of the following documents, that is to say, any pleadings or other documents relating to any civil proceedings then pending in the Supreme Court.” On its face, the meaning of the words seem to be pretty clear: if a case is pending (not concluded), a member of the public cannot inspect or obtain copies of the court records. The problem with that interpretation is that it clashes with the “Open Justice” principle. With few exceptions — understandably such as family, child welfare, reorganizing family trusts, national security cases — section 6 (9) of the Constitution requires that hearings must be held in public, and that not only means the actual trial but any interim hearing or application such as the Government’s application to strike out Michael MacLean’s constitutional action where he seeks, on behalf of a company and a trust, ownership rights over the City of Hamilton’s waterfront property. As part of the claim, Mr MacLean, in a written affirmation leaked to various media outlets before the hearing, made serious allegations of corruption on the part of two government ministers and a former premier. The public, who included the media, packed into the Chief Justice’s courtroom last Monday and Tuesday and watched the proceedings unfold. The matter was without question a matter of public importance and interest and, not surprisingly, the press wished to report on the hearing. The strikeout hearing was conducted in the same manner as all such hearings have been conducted in Bermuda. The judge had read the pleadings and the affidavits/affirmations in advance of the hearing and this gave the lawyers the convenience of needing to highlight only those parts of the evidence that advanced their respective arguments. The Chief Justice and the lawyers saw and understood the whole case because they each had access to all of the evidence. The public, including the press, did not as they heard only the cherry-picked snippets of the evidence that the lawyers highlighted in court. The process prevented the press from giving a full account of what was actually before the Chief Justice, which was all of the evidence. Bermuda Press quite rightly saw and felt the injustice of this process. Having a public hearing does not uphold the principle of “Open Justice” if the public cannot see or hear all of the evidence. Bermuda Press, through its attorneys, applied under the Supreme Court (Records) Act, and the Registrar of the Supreme Court understandably applied the untested and orthodox view and said that, pursuant to the longstanding practice of the Court, copies of the evidence could not be released at this time. The case was still pending and no final judgment had been given. The Act gave an express right of appeal to a judge, and the Chief Justice, appreciating the urgency of the matter, heard the appeal last Tuesday afternoon and considered further written arguments during the week. Bermuda Press advanced a number of arguments as to why the orthodox view should be overturned. What the Chief Justice agreed with, and what won the day, is that section 3(2)(a) provides a previously undiscovered key to the door that has kept Court records locked away and out of sight until the case has been completed. The key was found in the beginning words of section 3(2)(a) of the Act: ‘‘Any person not entitled by any provision of law, and not duly authorized in that behalf.’’ Bermuda Press successfully argued that if a member of the public can point to a law that gives access to the documents, then the Registrar should in a proper case — a case of public importance, for instance — release the pleadings and the evidence. The law that gives such access is the common law principle of “Open Justice”, which is enshrined in and underpins section 6(9) of the Constitution. The Chief Justice readily accepted that in cases where the public interest is clearly engaged, then it cannot be right to restrict the public to just those few passages of the evidence that are read out in court. The public are entitled to obtain copies of all of the evidence that is before the court, even though only select passages were mentioned in the hearing. The judgment now means that the Registrar has a discretion whenever she considers an application for inspection or copies of court documents which discretion must be exercised reasonably and with the “Open Justice” principle in mind. Cases with no real public-interest element are unlikely to result in the release of evidence before the conclusion of the matter. But where the public interest is strong, the documents are likely to be released much earlier in the proceedings. This is a monumental step forward for Bermuda. The public will be aware that the Chief Justice’s judgment allowed the parties to the Allied action to black out or redact certain parts of the evidence that was of a private or confidential nature. Bermuda Press’s attorney was part of the process. There were only a very few redactions requested and they pertained to references to wholly irrelevant matters that have nothing at all to do with the waterfront or the actual dispute. Bermuda Press had no objection to these limited blackouts. The Chief Justice allowed the redactions to be made. The public will have access to 99.9 per cent of what was before the Court. Access to justice was the primary focus of the appeal. There was one other important aspect or consequence of the case that the public need to understand, and that is the consequences that flow from members of the press or the public publishing leaked court documents as opposed to documents obtained by making a proper application under the Supreme Court (Records) Act. The Royal Gazette, which is published by Bermuda Press, sensibly refrained from printing the leaked MacLean affirmation that originally caused such a stir. It did this on advice that if the leaked contents turned out to be untrue, particularly the allegations of corruption, the Gazette could be sued for defamation by those whose reputations have been damaged. In addition, the press have a duty to publish court proceedings in a fair and balanced way. Publishing only Mr Maclean’s allegations without publishing the response affidavits of the ministers and the former Premier, would not be presenting a fair account. The public have an expectation of seeing and evaluating both sides of a story. There lie the dangers and pitfalls of publishing leaked affidavits and affirmations. Publishing what is said in court, even when what is said is untrue is permissible, and the law gives the public and the press the right to publish and discuss such matters. Likewise, if affidavits and affirmations are obtained properly and lawfully under the provisions of the Supreme Court (Records) Act, the press can publish the material even if the contents subsequently are proven to have been defamatory. The Court of Appeal decided this in 1993 in the case of Bermuda Press and Julian Hall. As a result of the Chief Justice’s landmark ruling, Bermuda overnight joins those enlightened jurisdictions that give meaningful access to justice. This was long overdue but, make no mistake about it, positive changes in our justice system comes oftentimes from an engaged and vigilant public and free press. Bermuda Press deserves to be commended for opening the doors of justice. The public should now, with appropriate safeguards, be able to have meaningful access to the workings of our courts. The ruling will no doubt result in future guidelines for obtaining court documents, but undoubtedly the “Open Justice” principle will be given the respect that it demands."

July 28. Maurice Cottle, a former consultant in the Attorney-General’s chambers, strongly denies claims he knew Mark Pettingill, the former Attorney-General, was acting corruptly in the Hamilton waterfront controversy. Mr Cottle’s sworn affirmation, released yesterday after a landmark ruling from Chief Justice Ian Kawaley, comes in response to allegations, including an alleged death threat, in an affidavit from Llewellyn Peniston. Mr Peniston had filed in support of Michael MacLean, the businessman locked in a court battle with the Bermuda Government, stating he had met Mr Cottle in late 2013, after being told he was helping evaluate the waterfront site. “When I saw Cottle on Church Street one day,” states Mr Peniston, “I pulled him aside and let him know that I was aware of his instructions to give some advice with respect to the waterfront. I told him to be very careful because he might be unwittingly planting himself in a bad professional position, possibly because Pettingill may have needed support for his personal position. He did not show any emotion when I revealed that I had been made aware of an offshore bank account in the British Virgin Islands that belonged to Pettingill, and that it was suggested that that bank account be used to facilitate the payment of money from MacLean to Pettingill personally.” Replying in his affidavit, Mr Cottle denies ever being involved in evaluating the waterfront, continuing: “I knew nothing of the allegation in Mr Peniston’s affidavit that Mr Pettingill had an offshore bank account in the British Virgin Islands which was to ‘be used to facilitate the payment of money from Mr MacLean to Pettingill personally’ until I read his affidavit.” In his own affidavit, Mr Pettingill dismisses the claims against him as “deplorable nonsense.” According to Mr Peniston, shortly after his conversation with Mr Cottle, he received threats from businessman Steven DeCosta in a meeting at Evans Bay in Southampton. “As soon as he reached me, he began to shout,” states Mr Peniston. He was pointing in my face. He said that if I divulged anything about the ‘financial arrangements’ of his ‘political colleagues’ in respect to their payment from the waterfront agreement, I would be killed. He was adamant that I should think about getting out of Bermuda for my own good. It was impossible for me to say anything in response to this because of how irate DeCosta was. Once he issued the threat, he left me standing there.” In his response, Mr Cottle says that Mr Peniston had urged him not to hold up the progress of the development as he stood to benefit from it financially. Mr Cottle adds that he had previously worked for Mr Peniston’s law firm Peniston and Associates, noting: “Mr Peniston did not conduct himself in the manner expected of any attorney/barrister; he had scant, if any, regard for the truth, or ethics if he stood to benefit; and his word was not his bond.”